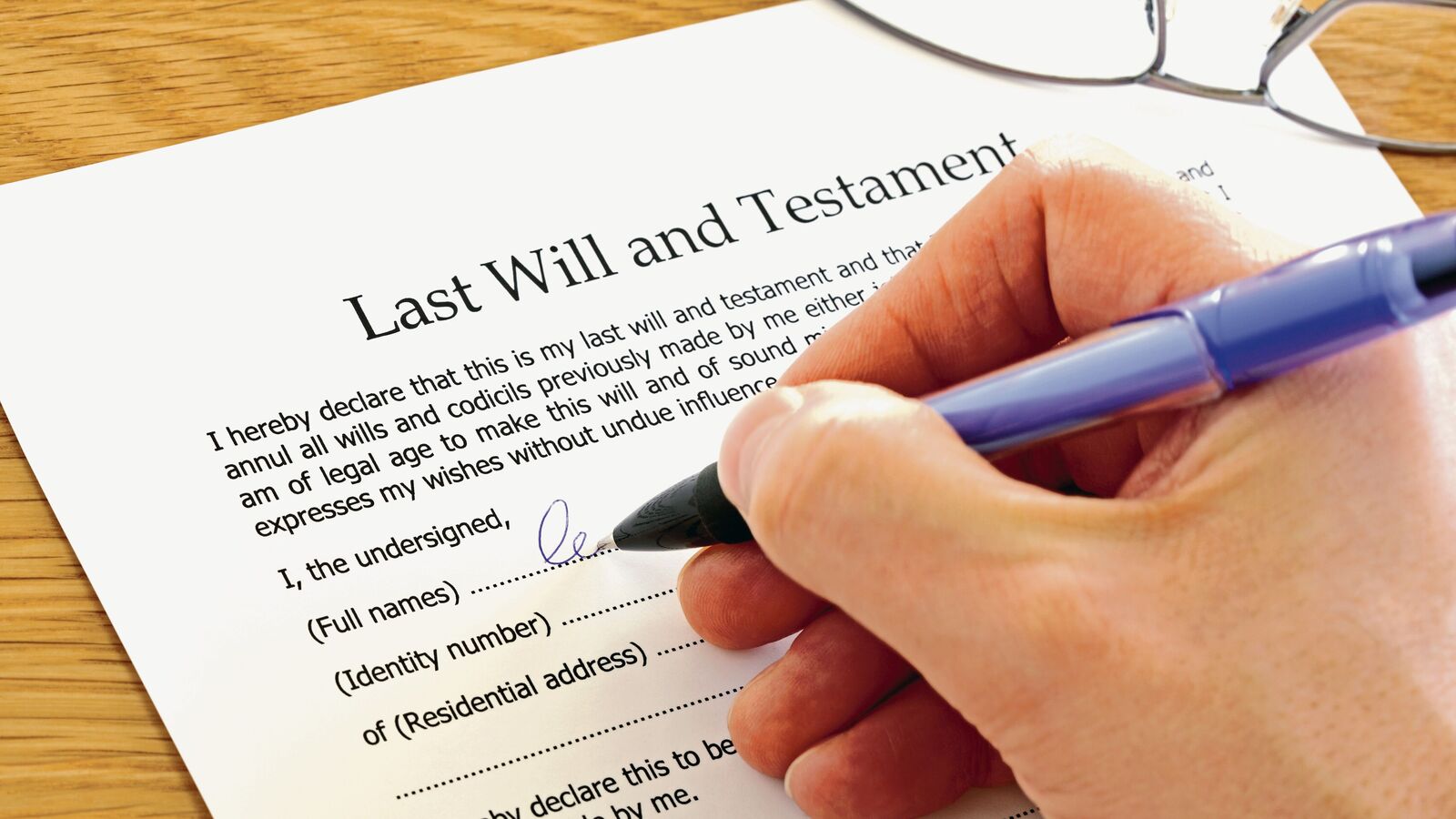

A basic will may not always protect your family. Here’s how a conditional will can help.

That’s where a conditional will—one that lets you define how, when and under what circumstances your wealth is passed on—can make all the difference. Families are increasingly using such wills to ensure their plans hold firm even when life takes an expected turn. Conditional wills As the same suggests, a conditional or contingent will takes … Read more