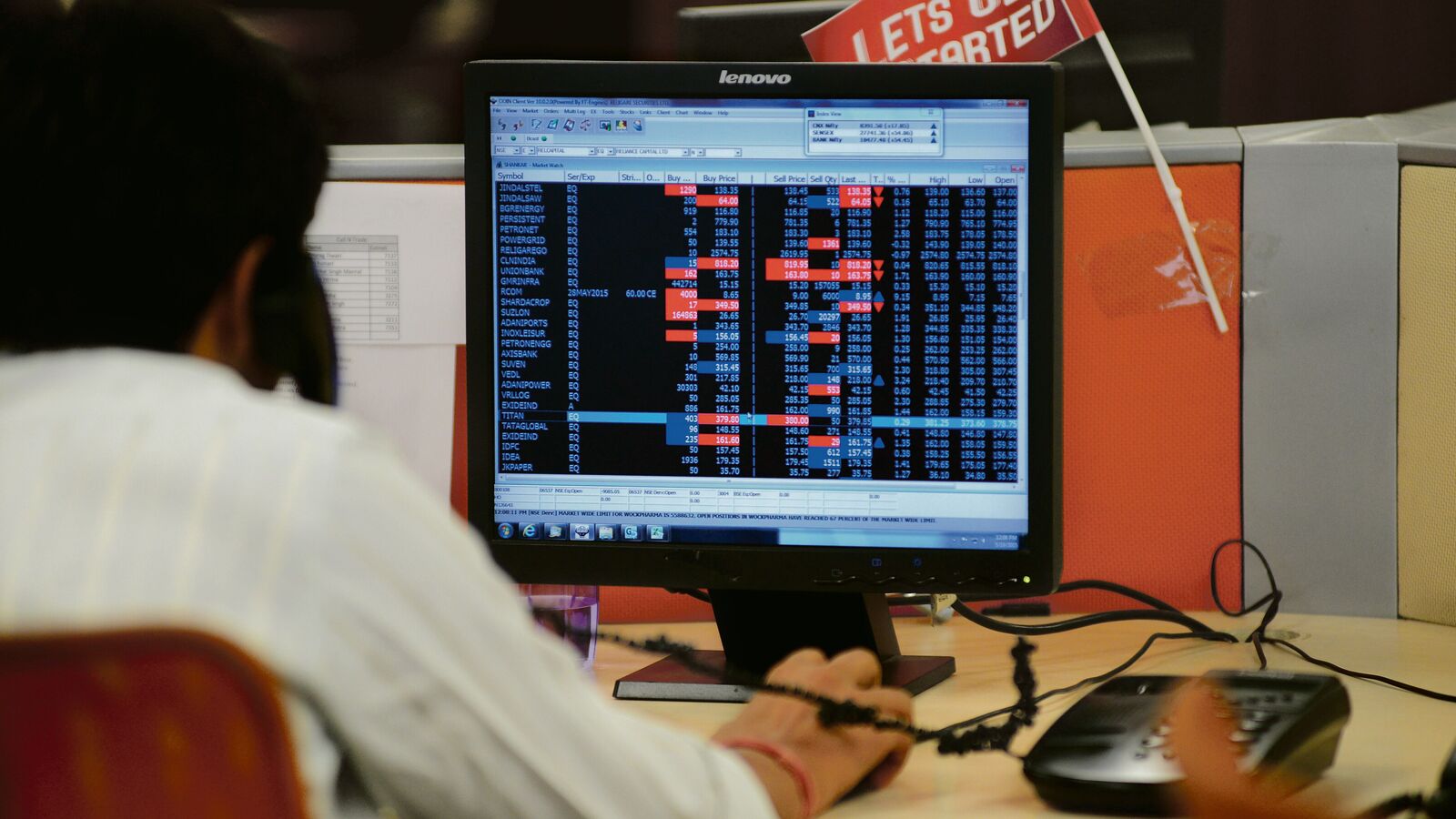

20% levy on short-term capital gains has given young F&O traders a tax incentive

NEW DELHI : Ahead of the Union Budget 2024-25, rumours were rife that tax on futures and options (F&O) would be increased to curb the increasing retail participation in the derivatives market. But while the Centre didn’t touch F&O, barring a nominal increase in securities transaction tax (STT), it increased tax on short- and long-term … Read more