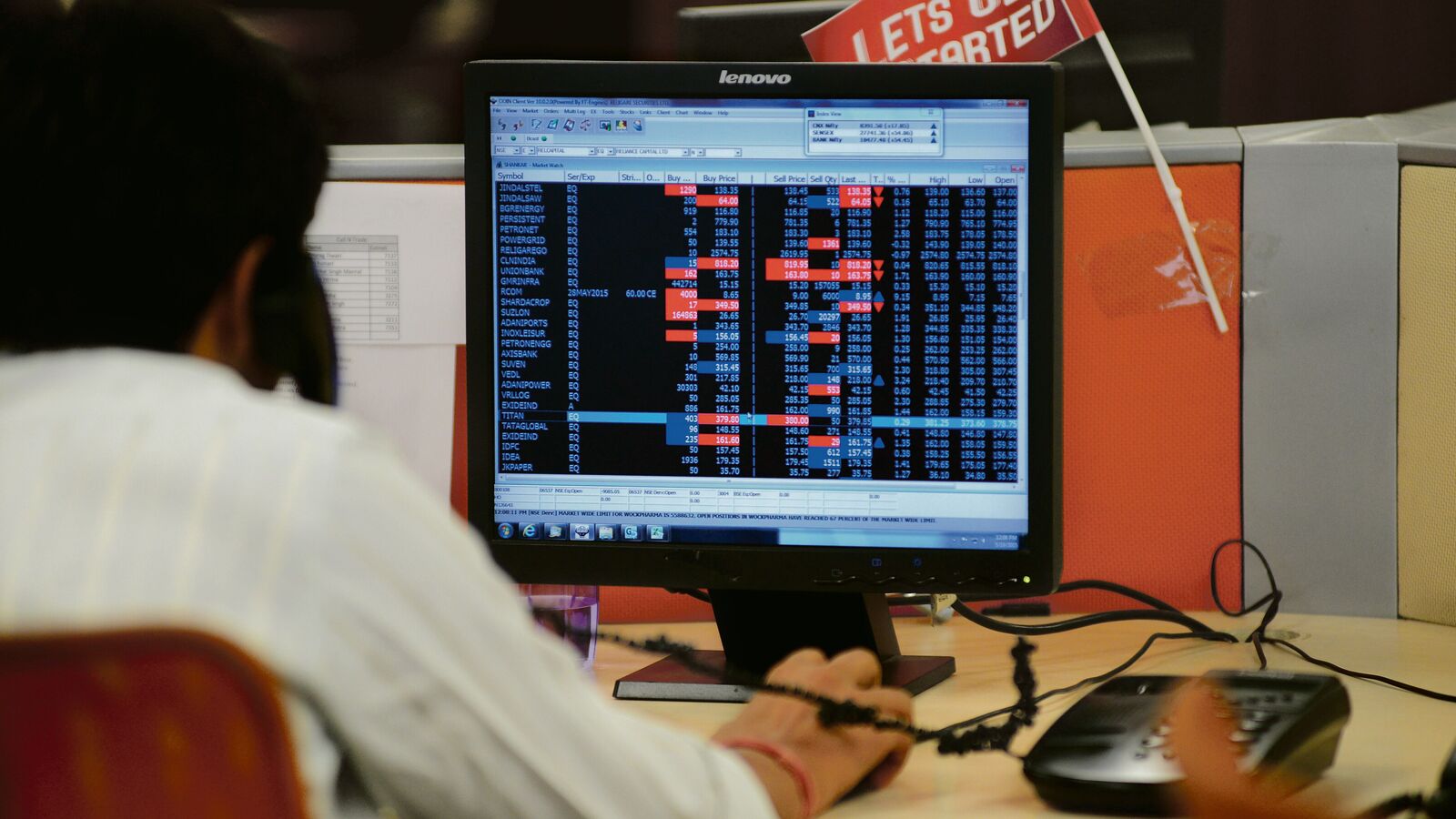

Budget may hike tax on F&O trading. Here’s what it could mean

The finance ministry plans to impose higher taxes on futures & options (F&O) transactions in the upcoming Union Budget, as per recent reports. Proposed changes include reclassifying these transactions as ‘speculative income’ from ‘non-speculative business income’ and potentially introducing TDS on them. This news has unsettled the trader community. Let us understand why. Derivatives are … Read more