Here’s everything you need to know about it.

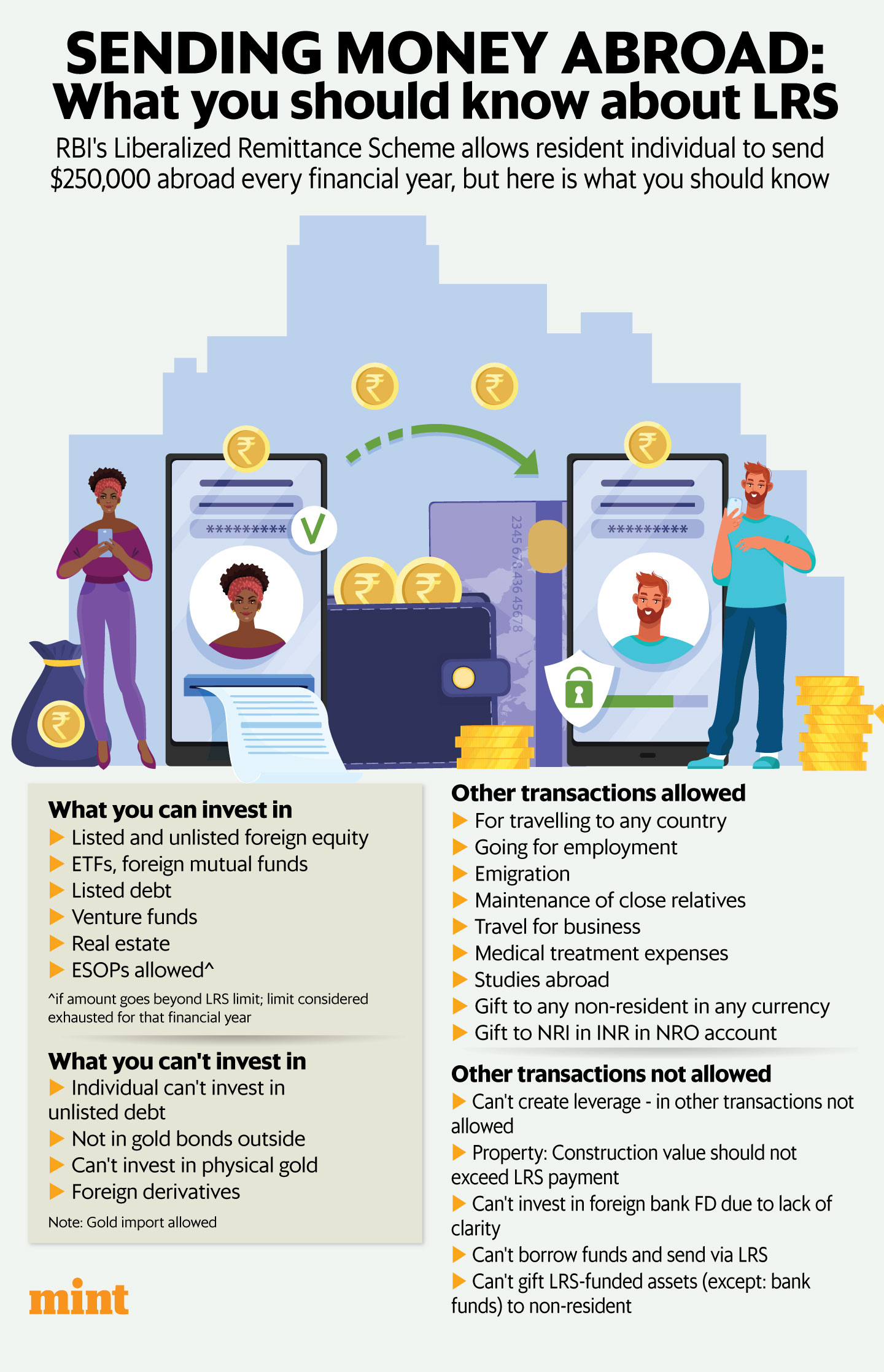

Investments

LRS allows Indians to invest in listed foreign securities – both equity and debt. You can invest in mutual funds, exchange traded funds (ETFs), venture funds, and real estate (with some caveats). You can also invest in listed debt securities such as bonds, but not unlisted debt.

“For example, you can invest in bond ETFs but not US Treasury bills since they are unlisted,” said Harshal Bhuta, partner at chartered accountancy firm PR Bhuta & Co.

Also read: Your credit card has been compromised. What should you do next?

You can’t use it to buy physical gold or gold bonds outside India either, though you can import gold through LRS. Also, investing in derivatives listed on overseas exchanges is not allowed.

Other transactions

You can use your LRS quota for foreign trips, including business travel. You can also use it if you are moving overseas for a job, or to send money to close relatives who are non-resident Indians (NRIs). Other uses include medical treatment and studying abroad.

What you can’t do is create leverage in foreign currency in a foreign bank. While you can technically use it buy an under-construction property abroad, you need to be careful as the RBI may see it as a violation if the value of the construction work exceeds the LRS payment.

You can’t use to it put money in a bank fixed deposit abroad owing to a lack of clarity. “It appears that investment in fixed deposits offshore is not specified in the list of permitted investments. However, it is not in the list of investments that are not permitted either,” said Prakash Hegde, a chartered accountant in Bengaluru.

Also read: Lessons in bank credit from Japan experience

Also, you can’t send borrowed funds abroad via LRS. “The funds being sent under LRS should be owned by you if the remittance is for a capital account transaction,” said Rutvik Sanghvi, partner at Rashmin Sanghvi & Associates.

Except for bank accounts, you can’t gift an LRS-funded asset or investment to a non-resident.

View Full Image

View Full Image

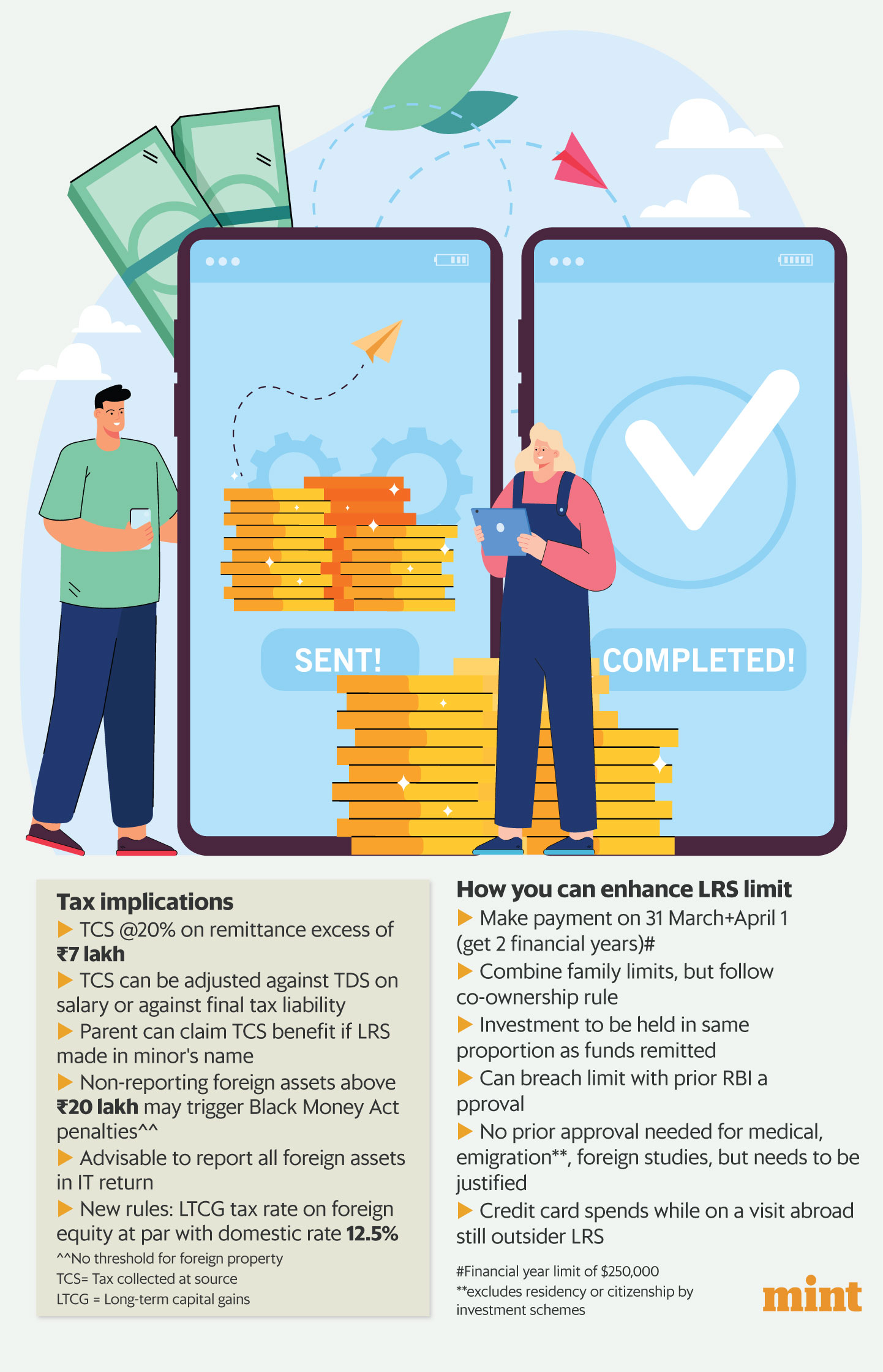

Enhancing limits

The RBI has a cap of $250,000 ( ₹2.07 crore) per financial year per individual under LRS. But there are ways in which you can send more in a calendar year.

If you send one payment before 31 March and the next after 1 April, you get the benefit of two financial years. So, you can send up to $500,000 in a given calendar year.

You can also club the LRS quotas of your family members to get a higher limit. But remember: if a husband and wife remit money in one bank account for an investment, the investment has to be made in the same proportion in which the funds were remitted. If the investment is not in proportion, it translates to gifting by one resident to another outside India, which is not allowed.

Also read | French holiday: A dream trip, but a costly splurge

You can even take the prior approval of the RBI if you wish to exceed the financial-year limit. For things like overseas education, medical treatment, emigration (except for residency/citizenship by investment schemes), no prior RBI approval is needed, but this needs to be justified with proper documents.

Tax implications

There is a 20% tax collected at source (TCS) on LRS transactions above ₹7 lakh in a fiscal year. For example, if you send ₹8 lakh aroad, the government will charge you 20% on the excess ₹1 lakh.

The new budget rules, however, allow the TCS credit to be taken against tax deducted at source (TDS) from your salary. This means an individual taxpayer need not wait until end of the financial year, and can declare the TCS with his or her employer.

Also read: GIFT City isn’t just for NRIs and foreigners—it has something for everyone

Though the new budget rules say that not reporting foreign assets below ₹20 lakh won’t trigger penalties under the Black Money Act, it is still a mandatory to disclose all such assets in your income tax return.

A2 form

To avail of the LRS you need to submit A2 form to your authorised dealer (AD) and mention the purpose code. Transaction-wise remittances under LRS are reported to the RBI on a daily basis.