Not only will this amount to significant savings when buying foreign currencies for overseas travel, it will also make spending towards fees or investments abroad a much smoother process.

That said, the money parked in Gift City foreign currency accounts can only be used for purposes permitted in the Liberalised Remittance Scheme. LRS allows resident Indians to remit funds abroad for specified purposes without any restrictions or approval from RBI.

Until now, such accounts were limited to investing in securities in Gift City and education-related payments, but RBI’s decision, announced on Wednesday, has broadened the scope for remittances.

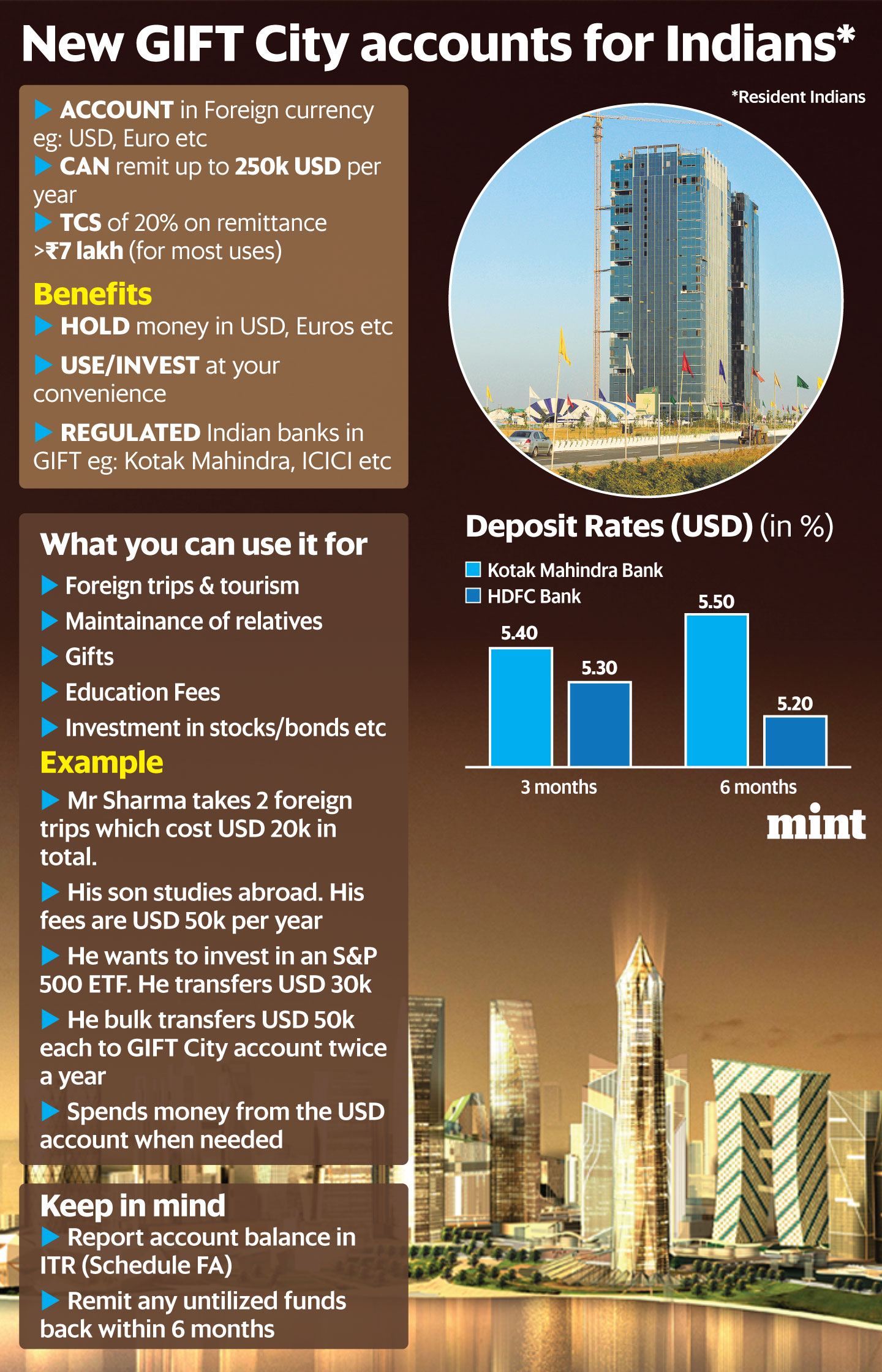

Uses of a Gift City account

If you are a frequent traveller to foreign countries, buying foreign currencies in India can be expensive and cumbersome. Banks and other foreign exchange dealers charge huge spreads (5-10% for small amounts). It also means filling out a form each time and providing details such as passport number.

If you are able to hold the forex in a US dollar account in Gift City with an attached debit card, you can just transfer a bulk amount in one go. The amount will earn interest, and you can simply spend it whenever you go abroad.

The fact that the US dollar historically appreciates against the Indian rupee is a bonus point.

View Full Image

If you are a student or a parent, you can park the money in the Gift City account and remit it whenever needed for university or hostel fees and living expenses. This would also save you forex conversion charges (you are generally offered a better rate on a bulk amount).

Similar benefits apply if you support relatives outside India or gift money to them. If you also invest outside India, the account can be used to stagger your investments (say, a systematic investment plan in a stock or fund abroad).

Another use case is for employees of foreign companies who have Esops (employee stock ownership plan) or restricted stock units of the parent company situated outside India. They can remit the sale proceeds of such stock options to these foreign currency accounts.

“Sale proceeds of ESOPs or RSUs can be transferred in, but if the money is not used to invest further, it has to be remitted back to India within 180 days,” said Jaiman Patel, tax partner, EY India. “The (Foreign Exchange Management Act, or FEMA) guidelines apply here and the sale proceeds can’t be left in the account for over six months.”

A number of Indian banks such as ICICI Bank Ltd and Kotak Mahindra Bank Ltd have launched operations in Gift City. Various funds have also launched alternative investment funds, such as the one run by Aditya Birla Sun Life AMC.

Benefits

You can park your money with well-known Indian banks such as ICICI Bank, Axis Bank Ltd, Indusind Bank Ltd, or HDFC Bank Ltd, which are regulated by RBI in India and by IFSCA (International Financial Services Center Authority) in Gift City.

Meeting the bank staff based in Gift City (near Gandhinagar) will be easier than opening accounts in Singapore or London. The interest rates in Gift City are also slightly higher than that of mainstream banks in the US or Europe.

For non-resident Indians, there is no tax on the interest on such accounts. For resident Indians, however, such interest is fully taxable.

Roadblocks

RBI rules require that unused funds be remitted back to India within six months. This can create complications if your payments are staggered over multiple years. For example, if you have to pay course fees for the next two years or want to set aside travel money for the next 12-18 months.

“Resident Indians remitting money for a specific purpose must use it accordingly. For example, if you remit money for tourism, you must either utilize it within six months or remit it back. This rule doesn’t apply once the purpose is fulfilled,” said Lalit Jadhav, partner, financial services, BDO India, a tax advisory and business services firm.

“For instance, if you remit money for investment and invest in foreign stocks, any subsequent earnings, such as dividends or proceeds from selling stocks, can be reinvested or saved for future investments,” Jadhav said.

Points to note

The money you remit will be subject to tax collected at source (TCS). This is 20% for amounts above ₹7 lakh in most cases.

You also have to disclose the account balance and any investments you make in Schedule FA of your Income Tax Return every year.

Also, you cannot use the money for purposes prohibited by RBI, such as for forex or derivatives trading.

Conclusion

RBI’s latest decision opens up many possibilities for Indians when it comes to investing, travelling, or studying abroad.

However, be mindful of the strict tax rules surrounding disclosures of such assets as well as foreign exchange rules. You cannot use funds remitted under LRS for derivatives or forex trading.

Also Read| Why startups aren’t chuffed about listing on Gift City exchanges