The visa allows individuals to avail of local services like banking facilities, communication services, rental housing, etc. to help with their work life.

Eligibility

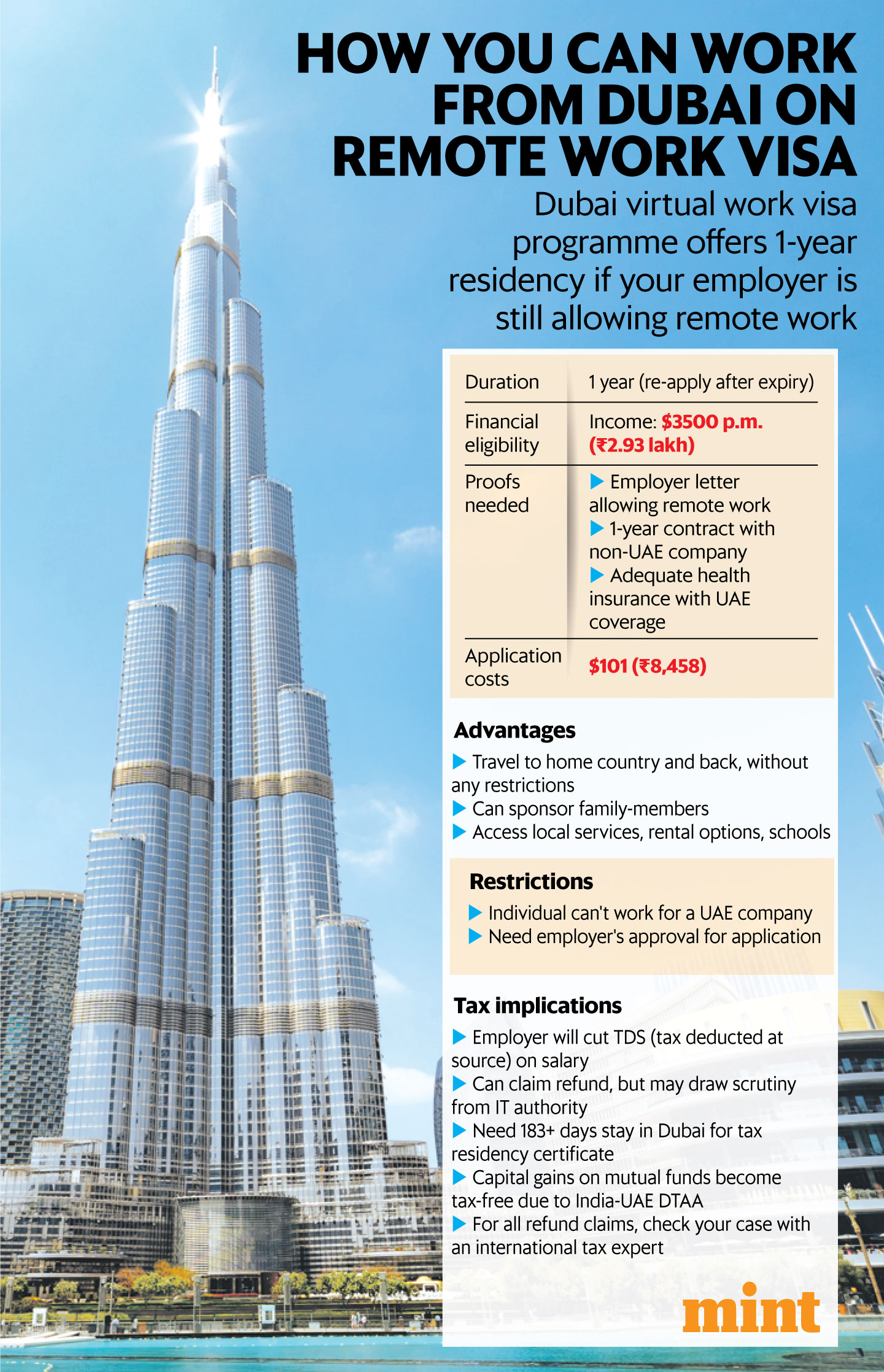

You need to submit proof of your current employment. For starters, you are required to submit proof that you are employed by a non-UAE company with a contract of at least one year. Besides, a proof by your employer stating that you can work remotely.

Most importantly, you need to submit your payslips to prove that your minimum monthly salary is $3,500 ( ₹2.93 lakh). Additionally, you are required to submit bank statements for the last six months.

View Full Image

Rights

With this visa, you can travel between your home country and Dubai multiple times. There is no minimum stay requirement or entry limits during the course of one year, while this visa is valid.

“It is like an extended tourist visa for someone looking to work out of Dubai for a longer period, as well as explore the culture,” says Arindam Sengupta, founder of education-focussed fintech startup Myglobalcitizenship.

However, you cannot be away from the UAE for more than six months continuously. If you are outside the UAE for more than six straight months, the visa will be cancelled.

Also read: How to obtain a Dubai Golden Visa through real estate investment

The remote-working visa allows people to sponsor their spouses as well as children. It even allows them to send their children to education facilities in Dubai. The visa, which is valid across the UAE, is issued by the General Directorate of Residency and Foreigners Affairs-Dubai (GDRFAD).

Costs

The base fee for applying for the visa is $101 ( ₹8,458). You are required to have health insurance with UAE coverage validity or travel insurance with healthcare coverage, which can then be changed to UAE health insurance once your visa formalities are complete.

Renewal

The Dubai remote-working visa only comes with one-year validity. However, you can reapply after expiry. The UAE generally offers a grace period to those on residency visas after expiry. You can reapply during this period. However, there might be additional charges for overstaying.

Taxation

Dubai is a tax haven as there is zero personal income tax. You become a tax resident of the UAE if you stay 183 days or more. You can take advantage of the India-UAE double taxation anti-avoidance treaty (DTAA) to avoid paying capital gains taxes on your mutual fund investments in India. But for a salaried income, there are two differing views on what would be the tax implications. The place of salary accrual, DTAA, applicability of the tie-break test (tests that need to be run to break the tie in favour of one of the two countries), etc. have been subject matter before various courts.

In any case, the employer would be obligated to collect tax deducted at source (TDS) as per your income tax slab rate.

One view is that despite relocating to Dubai for remote work, you would be liable to pay taxes in India.

“Salary accrues in India where services are rendered in India and would then be taxable in India. If the employee’s place of posting is in India, the presumption would be that the salary accrues in India. For employees posted abroad, since services are officially rendered abroad, the salary would not be taxable in India,” says Gautam Nayak, partner at CNK & Associates.

The other view is that the service rendered is linked to the employee’s physical presence.

“Salary income—when paid to a foreign bank account and accruing outside India—does not get taxed even for a deemed tax resident under section 6(1A) since the individual will remain as RNOR (resident but not ordinary resident). Deemed tax residents under section 6(1A) automatically become RNOR. For salary paid to an Indian bank account, such deemed tax residents may take benefit of certain judicial rulings to claim non-taxation in India. Further, individuals can also take the benefit of the DTAA if they can satisfy the tie-breaker test in favour of the UAE,” says Harshal Bhuta, partner at P.R. Bhuta & Co. Chartered Accountants.

“The taxpayer would need to furnish a tax residency certificate issued by the foreign tax authorities to claim the benefit of the tax treaty that can help their tax refund claim. Just because the salary is credited to an Indian bank account, the salary of a non-resident cannot be taxed under Indian tax regulations. If the individual has worked in India for one month out of 12 months in a financial year, they are liable to pay taxes under Indian tax regulations for one month. But for 11 months, during which the individual has worked from outside India, they can claim tax refund by submitting a valid tax residency certificate,” says Prakash Hegde, a Bengaluru-based chartered accountant.

“Even without a tax residency certificate, a non-resident would be able to claim the tax refund for the period for which they have not worked in India, but with a risk of litigation at the lower level,” Hegde adds.