Fixed-income investments such as fixed deposit (FD) interest, bond interest, and debt mutual funds are typically taxed at the marginal rate (slab rate).

The 2023 budget had abolished the benefit of long-term capital gains tax or LTCG for debt mutual funds. However, there’s a notable exception in the tax system for certain bond transactions.

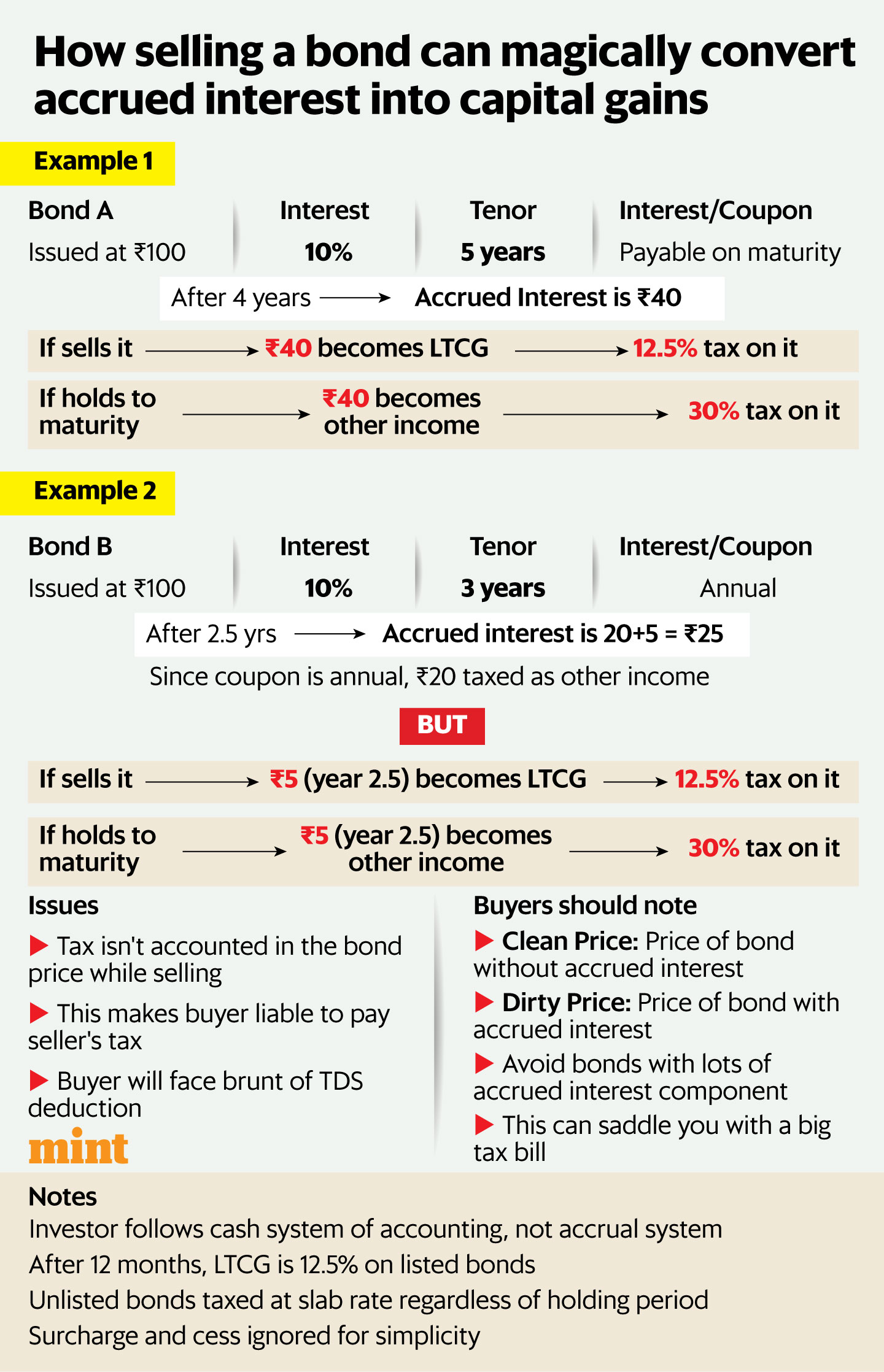

If you sell a listed bond after 12 months, your gains are taxed at 12.5%–the rate for LTCG, not the slab rate. This benefit is only available for listed bonds. The 2024 Budget brought in slab rate taxation for unlisted bonds regardless of the holding period. Your gains, in this case, can include both accrued interest and ‘genuine’ capital gains – but the tax system doesn’t distinguish between the two.

How it works

Let’s say you buy a bond for ₹100. It has a three-year tenor and a coupon (interest) of 10% payable on maturity. After two and a half years, it has accrued interest of ₹25. Now, you sell the bond for ₹125. You are taxed at 12.5% on this gain of ₹25 rather than your marginal rate, which could be 30% at the highest slab rate. In this case, you pay a tax of ₹3.1 instead of ₹7.5, which is about 60% less.

View Full Image

Most bonds, however, offer periodic coupon payments rather than cumulative interest on maturity. Even in this case, selling the bond saves some tax. For example, in the above example, say the coupon payment is annual and the maturity value is also ₹100. This means you would have got ₹10 each in the first and second year, and paid tax at your slab rate (30%). However, in the third year, your accrued interest is ₹5. This would get taxed as capital gains, assuming you sell the bond with the accrued interest embedded in the sale price–in this case, ₹105.

“Selling a bond before maturity can convert accrued interest to capital gains. This is assuming you have held it for 12 months for listed bonds and you are following the cash system of accounting and not the accrual system,” said Gautam Nayak, partner, CNK Associates.

“This can lower your tax rate from marginal rate to 12.5%. But note that the buyer of the bond will have to pay tax on this accrued interest and will also face TDS on income that is yours as a seller. Most institutions deduct TDS at the time of coupon payment or on the maturity of the bond. It isn’t clear if you will find a buyer who will take on this hidden cost,” Nayak said.

Some online bond platforms avoid listing bonds with coupons payable at maturity and long tenors. According to Anshul Gupta, co-founder of Wint Wealth, the platform follows this policy to avoid issues for bond buyers.

Buyers beware

If you are a bond buyer or investor, it is very important to be aware of these implications. The National Stock Exchange (NSE) rules mandate that online bond platforms quote both the clean price (without accrued interest) and the dirty price (with accrued interest) of each bond.

This information helps you identify the amount of accrued interest. A significant accrued interest amount could lead to a tax shock, as the issuer will deduct TDS on your name, even though the seller earned the income (accrued interest).

“There are RBI bonds which a lot of traders are invested in. The interest is generally paid in May and November,” said Karan Batra, founder, Chartered Club.”If a trader sells before the interest payment dates, he is effectively converting accrued interest into capital gains (after one year this is LTCG at 12.5%). Budget 2024 has brought in TDS on RBI bonds. Hence buyers of these bonds will be saddled with TDS that should be deducted on the income of the seller.”

Also Read: How Bharat has betrayed Bharat Bond investors