Right outside Fernandes’s home is a poster of a woman who passed away recently. It grabs his attention each time he opens his gate. His eyes are then drawn to one of his favourite possessions, his bicycle, long unused, which reminds him of happier days.

Now, he can barely pick up his phone without using both hands. His wife serves him half a glass of tea to prevent it from spilling as his hands tremble with each sip. These are just a few signs of the toll chemotherapy has taken on his body. His doctors have warned him that he will soon need an oxygen cylinder wherever he goes and eventually become bedridden.

Also read: Navigating behavioural biases, market volatility, uncertainty while investing

Before the diagnosis, Fernandes cycled daily and ran half-marathons. The cancer, deemed inoperable, has left him with a slim chance of living beyond five years. Despite this grim prognosis, he remains focused on his family’s future.

A former fund manager, broking business owner and sales head at mutual fund houses, Fernandes taught finance and investment courses until recently. He continues to serve as chairman and director (public interest) at BSE Administration and Supervision Ltd, a subsidiary of BSE Ltd, supervising Sebi-registered investment advisors (RIAs) and research analysts (RAs).

Here are some edited excerpts from an interview.

How do you manage your monthly expenses?

When the Manipur crisis broke out, I saw an interview of my uncle, Dr Walter Fernandes SJ, with Karan Thapar. A few years ago I had tried supporting underprivileged children but encountered issues. After reconnecting with Walter, my wife and I decided to take in two girls, Celina and Marina, whose homes were destroyed. One is studying for her Std X exams and the other is pursuing a diploma in education.

“My wife and I decided to take in two girls, Celina and Marina, whose homes [in Manipur] were destroyed.”

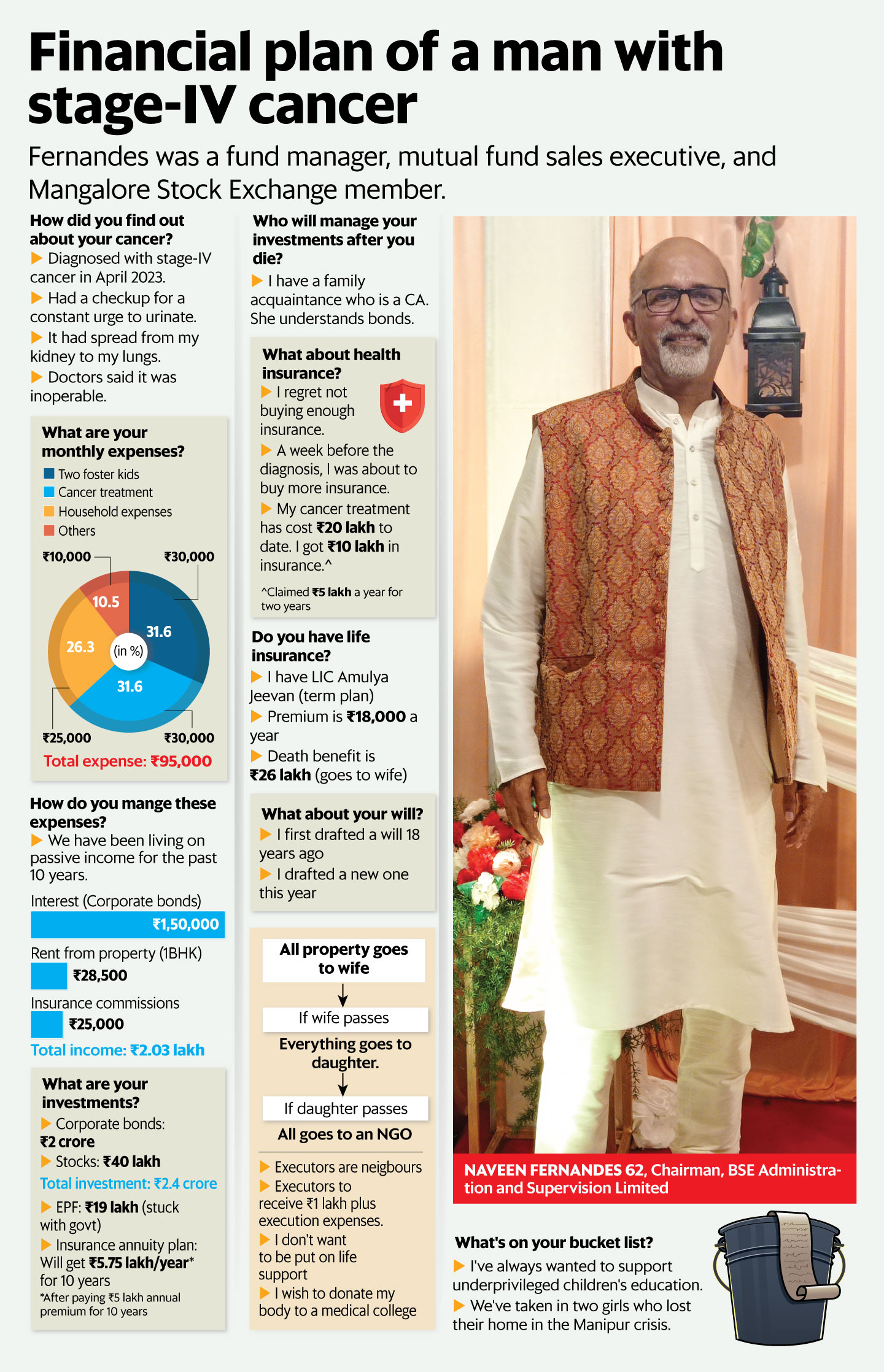

Our daughter’s room was empty since she works in Paris as a data scientist, so we had space for them. Their expenses work out to ₹30,000 a month, including education. Our daughter is financially independent so we don’t need to worry about her. Our household expenses are around ₹25,000 but unexpected costs can push it up to ₹35,000. My cancer treatment costs ₹30,000 a month, so we spend around ₹95,000 in total every month.

View Full Image

What if your treatment costs increase?

That’s unlikely. My doctors have told me that nothing more can be done at this stage. The cancer has already spread from my bladder to my lungs. If my condition worsens I’ll need oxygen cylinders, which aren’t very expensive.

How does your wife plan to manage the family’s finances in your absence?

My wife and I have been living on passive income for the past 10 years. I retired at 53 with financial assets of ₹1.3 crore, having moved back to Bengaluru from Mumbai. Back then, financial planners said I would need ₹3-5 crore for a comfortable retirement. But we believed what we had was enough because we lead a frugal life. I’ve seen people who earn much more than I did still borrowing money. I couldn’t bring myself to spend on unnecessary things, and my 15-year-old car is still fine.

After retirement, I was offered a monthly salary of more than ₹2 lakh to work part-time as the principal officer of an RIA firm. I had cleared the NISM (National Institute of Securities Markets) 10-A and 10-B exams. But instead I chose to give lectures at colleges, which I had always wanted to do. I ended up teaching finance at St. Joseph’s and later at Christ University for 10 years. Unfortunately, I had to stop three months ago because of my cancer. By the time I was 61, my family investments had compounded to ₹2.4 crore. I also receive ₹28,000 monthly rent from a 1BHK apartment.

Also read | Swiggy IPO: How investors justify risky pre-listing trading

I’ve invested about 80% of my portfolio ( ₹2 crore) in corporate bonds, which I feel comfortable with after years in the finance industry. The rest is in stocks. I usually pick corporate bonds that offer 10-12% interest and hold them until maturity. The return after taxes is around 9%, which comes to about ₹18 lakh a year or ₹1.5 lakh a month. With the ₹28,000 rental income, it’s a stable source of money.

“I’ve invested about 80% of my portfolio ( ₹2 crore) in corporate bonds, which I feel comfortable with after years in the finance industry. The rest is in stocks.”

I also hold an insurance-agent licence with 15 clients, though the commission income is small and irregular. When I’m no longer around, a family acquaintance, Marita Pinto, who is a chartered accountant, will manage my portfolio. She understands how I pick bonds, as does my wife, who has a background in commerce. She also helps manage the accounts of a home for the elderly.

Unfortunately, I have ₹19 lakh stuck in my Employees’ Provident Fund account. Trying to withdraw this has been a nightmare since 2019. I even travelled to Gurgaon but was told I had come to the wrong office. That account hasn’t earned interest in three years as it is inactive.

I also invest ₹5 lakh a year in ICICI Pru Guaranteed Income for Tomorrow (Long-Term) plan. This will provide a fixed return in the future, along with some tax benefits.

Why did you choose an insurance-cum-savings plan?

My corporate bond investments will mature in about five years, and I’m unsure what interest rates will be in the future. The insurance-cum-savings plan allows us to lock in a fixed interest rate for 20 or 30 years. We’ll contribute ₹5 lakh a year for 10 years, and from the 11th year onward, receive ₹5.75 lakh a year for 19 years. This income is tax-free because the premium is under ₹5 lakh a year.

Also read: A long bull run has made huge returns seem normal. Time to curb your enthusiasm.

The downside is the high commission. When I sell this product to clients, I make it clear how much commission I will earn, and I donate half of it to an NGO that supports children’s education. I don’t think anyone deserves high commissions. It’s criminal.

While the plan includes an investment component, the cover isn’t great. I treat it as a pure investment plan. I’ve intentionally listed my daughter as the ‘life-at-risk’ to slightly reduce the premium. This means the life insurance payout will be made when my daughter passes away. My wife will still receive the guaranteed income.

How much did your cancer treatment cost? Did you have health insurance?

I regret not buying more health insurance. I was sitting in the HDFC Ergo office with my relationship manager to buy a policy but I procrastinated. A week later, I was diagnosed with stage-IV cancer. That said, I had a family floater policy of ₹5 lakh for my wife and myself. The total treatment cost for my chemotherapy, radiation and immunotherapy was about ₹20 lakh. I claimed ₹5 lakh over two years, with insurance covering half of the treatment cost. I was paying a premium of ₹30,000 a year for that policy.

“I was in the HDFC Ergo office to buy health insurance but I procrastinated. A week later, I was diagnosed with stage-IV cancer.”

Also read: Insurance plan promises to double your money? How to calculate the actual return

I also have a term life policy, which I recommend to everyone. I advise against policies that offer money back. I have LIC’s Amulya Jeevan term plan with an assured sum of ₹26 lakh, which will go to my wife. I had limited options when I bought it, but better term insurance options are available now.

What about your will?

I wrote my first will 18 years ago, but updated it recently to reflect my current situation. Back then I had a flat in Mumbai; now I live in Bengaluru. I want everything to go to my wife, and if both of us pass away, our daughter will inherit everything. If she also passes, all my assets will go to an NGO that supports underprivileged children’s education. I’ve seen too many family disputes over property, and I don’t want that.

The two executors of my first will have passed away, so I appointed a neighbour as the new executor. I’ve set aside ₹1 lakh for him, plus execution expenses, to ensure it’s not a burden. If this executor is unavailable, I’ve appointed another neighbour as backup. I haven’t registered the will yet but plan to do so soon.

Is there anything else you’d like to say?

There’s too much misselling in the insurance industry, with people often being misled for commissions. The wealth management industry also prioritises products and commissions over clients’ needs.

“There’s too much misselling in the insurance industry, with people often being misled for commissions.”

As chairman of BASL, I’m pushing for the relaxation of RIA rules so that more people can become fee-only financial planners. While not all RIAs are good, they operate under strict regulations and the number of offenders is small. Currently, there are fewer than 1,000 active RIAs in the country and this number needs to grow. Those operating without licence and cheating clients should be punished severely to protect the small, voiceless investor.

On a personal note, I have donated my body to St. John’s Medical College. While my cancer may limit the scope of their study, they can still use body parts like my eyes. I’ve also written down that I don’t want to be put on life support and specifically mentioned that I don’t want to be kept alive on a ventilator. When the time comes, I’m ready to go peacefully.