Though the transition is complete, Axis Bank has chosen to keep Olympus exclusive to only Citi customers for now. An Axis Bank relationship manager, who did not wish to be named, told Mint that the bank would open the card to its Burgundy members soon but couldn’t give a timeline.

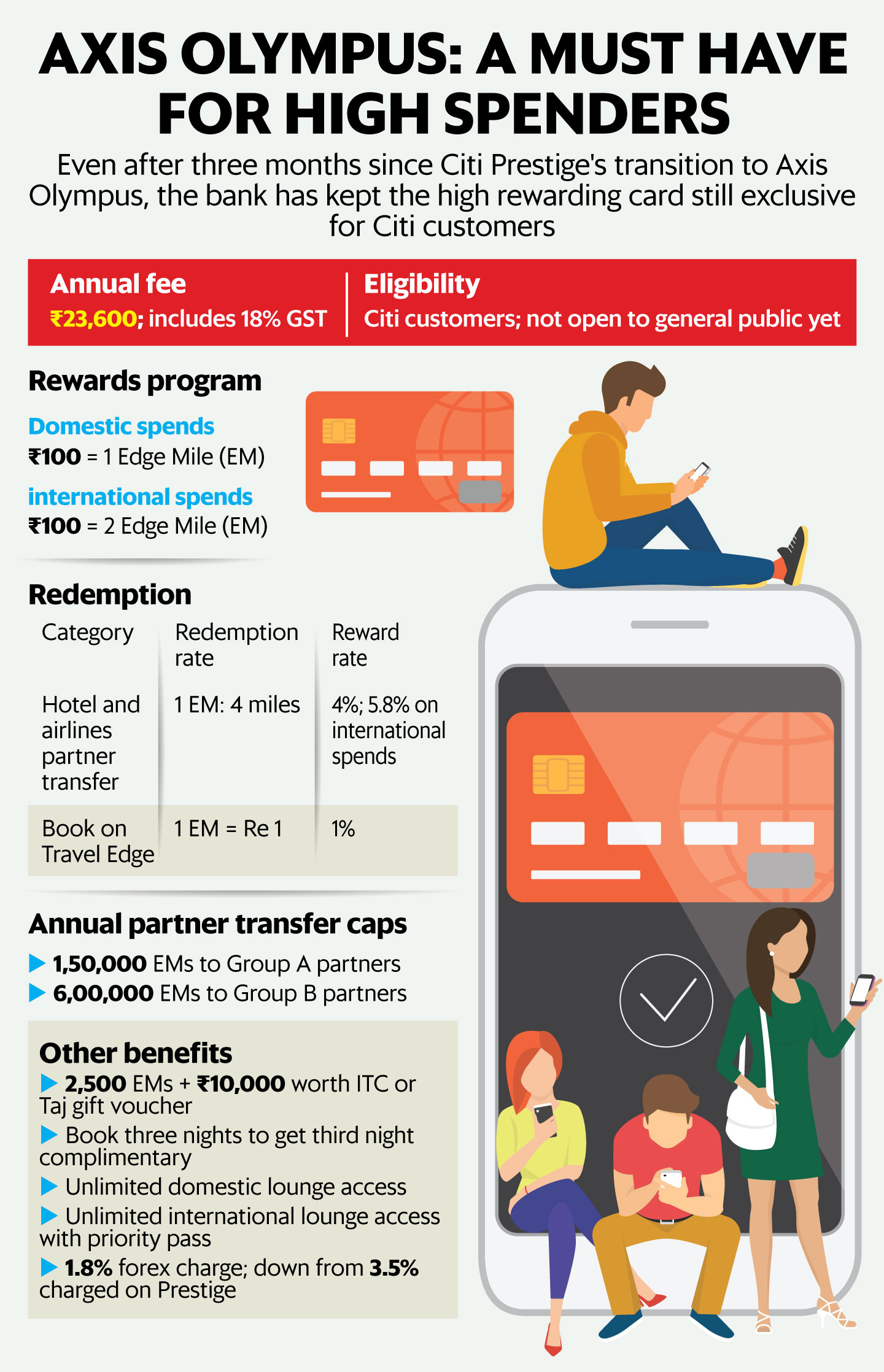

Axis has kept the annual fee of Olympus unchanged at ₹23,600, including 18% GST. This is four times the Axis Atlas fee, though the latter offers roughly the same reward rate. So, does it make sense to retain it?

View Full Image

Also Read: Axis Bank’s unthinkable move: A credit card you just can’t buy

High reward rate

For every ₹100 spent in domestic transactions, Olympus earns 1 Edge Miles (EM). The reward rate doubles to 2 EMs for ₹100 spent on international transactions. Reward points accumulated on Citi Prestige until migration has been converted to EMs.

Axis Bank has two reward programmes: EMs and Edge Reward Points (RPs). The former was so far only used for Axis Atlas, whereas all other cards earned RPs whose redemption value varied depending on whether they were redeemed as air miles, vouchers, or electronic items, among other categories.

Rewards earned on Olympus have been termed EMs and these are allowed to be transferred to partner hotels and airmiles at 1:4 ratio. Tejas Ghongadi, co-founder of The Points Code, a platform advising credit card users on optimising reward points, this ratio will translate into a 4% reward rate for most.

“For simple calculation, 1 air mile is equal to Re 1. But in most cases it is possible to get a higher value of ₹2-3 per air mile depending on how the redemption is done, which means the reward rate is higher than 4%,” he said.

Given the earning rate of 2 EMs per ₹100 on international spends, net rewards rate is much higher. However, it should be noted that a forex rate of 1.8% (excluding GST) is charged on Axis Olympus. At 1 air mile, which equals Re 1 value rate, the reward rate on international transactions works out to 5.8% after accounting for the forex charge, which makes it a highly rewarding card on international spending.

The forex charge Olympus is more generous than the 3.5% that was charged on Citi Prestige.

Apart from the reward rate, Olympus has outstanding secondary features as well.

- There’s an annual activation benefit of 2,500 EMs, which are least worth ₹10,000 for miles transfer along with a Taj or ITC gift voucher worth ₹10,000.

- Citi’s complimentary stay programme has seen an upgrade. Now, on a booking of three nights, the third night is complimentary. Citi used to offer to buy three nights to get the fourth night free.

- Olympus cardholders get unlimited domestic lounge access and, with a priority pass, unlimited international lounge access, too.

Is it better than Atlas?

At one fourth the fee, Axis Atlas’ reward rate is similar to Olympus. In fact, the former rewards generously on travel spends with the reward rate being 10%. On regular spends, excluding exempt categories, the reward rate on air miles redemption is 4%, same as Olympus.

So it begs the question whether it makes sense for Olympus users to keep using it in place of getting Axis Atlas.

Ghongadi says it does for high spenders. “Those with annual spends over ₹30 lakh can use both to their advantage due to the bifurcation of transfer partners in two groups with individual cappings on them,” he said.

Also Read | Cashback, discounts and rewards: The benefits of co-branded credit cards

Earlier this year, Axis had grouped hotel and airline partners into two groups with a cap on maximum rewards that can be transferred under each group in one year. The more frequently used partners, including Accor Hotels, Marriott International, Qatar Airways, United Airlines and Singapore Airlines, among others, are clubbed in Group A with lower redemption caps. Group B has Air India, ITC, Air France, Air Asia etc.

The rewards transfer cap is different across cards. In the case of Atlas, only 1,50,000 EMs are allowed to be transferred annually, distributed at 30,000 points in Group A and 1,20,000 in Group B. The annual limit is generous with Olympus at 7,50,000 of which 1,50,000 can be transferred in Group A and 6,00,000 in Group B.

“High spenders will benefit by using Atlas along with Axis Olympus. But if the annual spends are only ₹20-25 lakh, just sticking to Atlas should work as you wouldn’t accumulate more than 1,50,000 EMs in a year anyway,” Ghongadi explained.

Olympus is particularly a steal deal for those who travel extensively internationally, given its high reward rate on spending outside India.

As for Axis Bank’s reputation for devaluations, Olympus cardholders shouldn’t worry yet, Ghongadi said. “As the bank has kept it exclusive to Citi customers, I don’t expect it to be devalued anytime soon.”

Also Read: Your credit card has been compromised. What should you do next?