This was no flashy consumer brand but a business-to-business (B2B) player in the electronics sector—a sector not typically associated with Indian companies. The return on equity stood at a respectable 22%. Would you have been tempted to invest? Maybe, maybe not. I admit, I didn’t.

The company in question? Dixon Technologies.

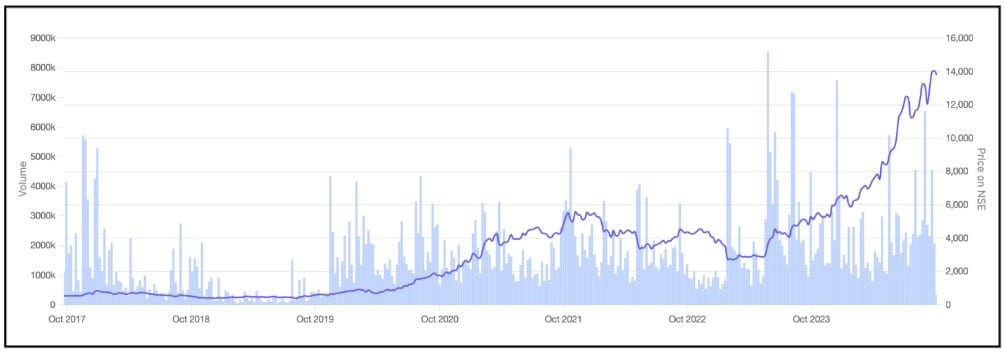

Since its IPO in 2017, Dixon’s stock has skyrocketed. Looking back, I see it as a missed opportunity for many, myself included. Those who did jump on board enjoyed a compound annual growth return (CAGR) of nearly 60%.

Dixon is nearing another milestone, potentially reaching a market capitalization of ₹1 trillion, which would mark a 20% rise from its current value.

What’s behind this impressive growth? Let’s dive into what might drive Dixon to these new heights or what challenges it could face along the way.

View Full Image

India’s rise in the global electronics market

Before diving deeper into what Dixon Technologies has been up to, let’s first get a clearer picture of the electronics manufacturing services (EMS) industry in India.

On a global scale, the EMS market is substantial, with a market of $928 billion in 2022. According to the draft red herring prospectus (DRHP) of Kaynes Technology India Ltd, another electronics manufacturer that went public in 2022, it’s projected to expand at a consistent annual growth rate of 5%, anticipated to reach $1,203 billion by 2027.

But it’s in India where the growth story gets really exciting.

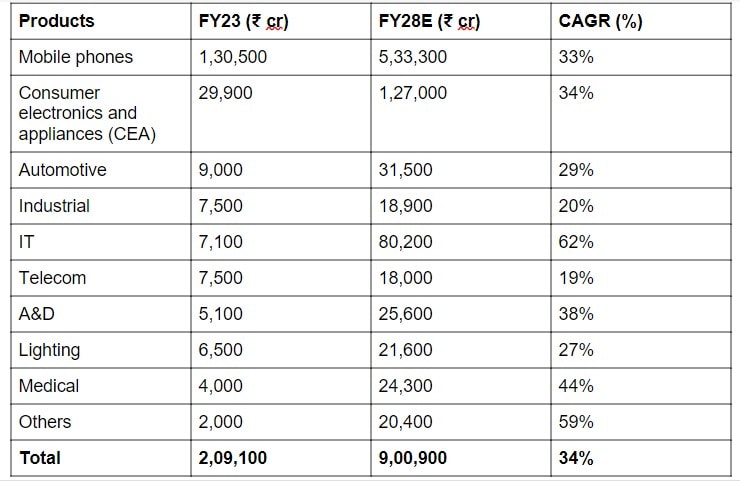

From a market size of ₹2 trillion ($25 billion), India’s EMS sector is projected to explode at a CAGR of 34%, potentially hitting ₹9 trillion ($110 billion) by 2028. This growth is fueled by a booming consumer economy and an increasing appetite for consumer and industrial electronics.

Also, the government’s push for self-reliance is reshaping the sector altogether. With initiatives aimed at boosting domestic electronics production, India is becoming an attractive hub for manufacturing investments.

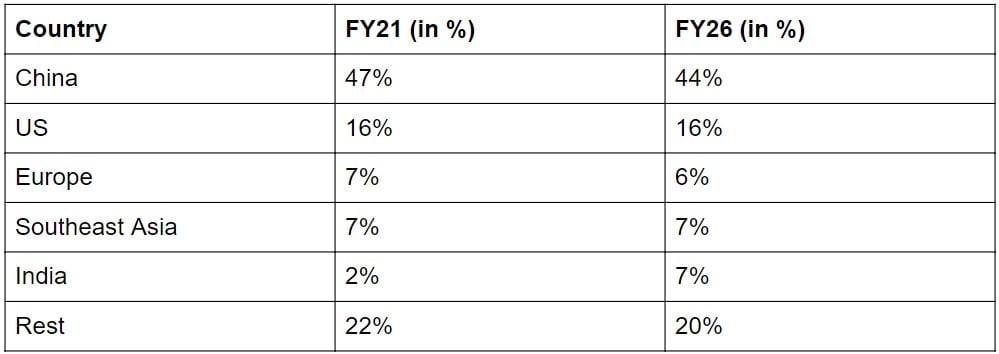

Although China dominates the global EMS market with about 47% share, the post-covid era has prompted many companies to adopt a “China + 1″ strategy. This approach involves seeking additional manufacturing bases outside of China, presenting a significant opportunity for countries like India. By 2026, it’s projected that India’s share in the global EMS market could increase from 2% to 7%.

View Full Image

So, why is India turning heads in the electronics manufacturing arena?

Cost advantages: Labour costs in India are significantly lower than in China, offering companies a considerable advantage in controlling expenses as they scale up production.

The approximate average daily labour cost stood at $6 in India, compared to Vietnam’s $11 and China’s $35 as of 2022, according to the DRHP of Avalon Technologies Ltd, which listed on bourses in 2023.

Minimizing import reliance: Nearly 30% of India’s demand for electronic products is currently met through imports. Recognizing the potential of the electronics sector to boost the nation’s gross domestic product (GDP) towards the $5 trillion goal, the Indian government has vigorously pushed for an increase in domestic electronics manufacturing. A robust set of incentives has been established to enhance infrastructure and reduce the costs associated with manufacturing and capital investments.

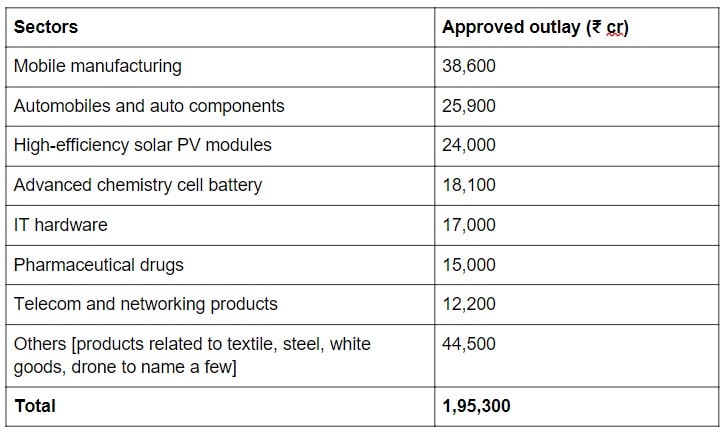

Government support through incentives: Production-linked incentive (PLI) schemes have been rolled out across 14 crucial sectors, including electronics. These schemes are specifically designed to draw investments and enhance the sales of goods manufactured within the country, helping propel India towards becoming a global manufacturing powerhouse.

View Full Image

Strong consumer market: The Indian market is predominantly driven by consumer demand, with items like mobile phones and consumer electronics accounting for over 65% of the business-to-consumer (B2C) segment. This is supported by India’s growing economy, rising disposable incomes, and evolving lifestyles.

View Full Image

The brand behind brands

You might not see Dixon Technologies on your gadgets, but they’re the powerhouse behind many brands you know and love.

Its tagline, “The brand behind brands”, sums up its role perfectly—it’s the unseen force driving the production and innovation for major electronics brands. Dixon’s approach is simple but highly effective: It enters a market, ramps up quickly, and enhances its integration to make its products more cost-effective. This strategy not only cuts costs but also keeps its customers coming back.

Essentially, Dixon’s success can be attributed to these factors:

Growing big, earning trust: Dixon’s journey started in 1994, manufacturing colour TVs. Since then, they’ve not only mastered other areas like LED TVs and washing machines but also claimed significant slices of the market pie. Now, it’s expanding into mobile and IT hardware manufacturing.

Imagine this: Dixon now makes 35% of India’s LED TVs, 50% of LED lamps and 15% of mobiles. Its decade-long run has shown a stellar 32% annual growth in revenue, proving it knows how to scale and succeed.

As Dixon expands, it does more than just grow—it deepens trust. It has consistently attracted new customers across various product categories and strengthened its relationships with top-tier brands.

For instance, its collaboration with Samsung started with washing machines and has grown significantly. By 2021, Dixon was manufacturing feature phones and smartphones for Samsung, and it now produces 60% of Samsung’s TVs and nearly all its smartwatches and true wireless stereo (TWS) devices in India. This breadth of manufacturing for Samsung shows just how much Dixon has come to be relied upon.

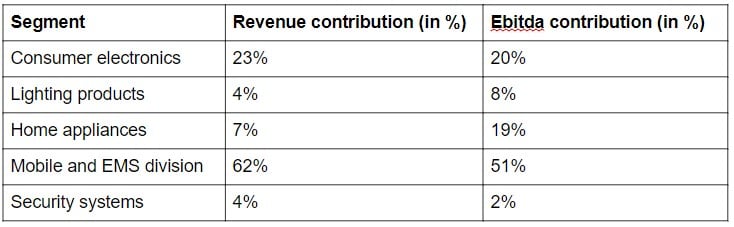

Execution excellence: Since its IPO in 2017, Dixon’s financial metrics have been impressive.

Its revenue, earnings before interest, taxes, depreciation, and amortization (Ebitda), and profit after tax (PAT) have all increased more than fourfold. During this period, it has reinvested ₹1,300 crore in expanding its capabilities and entering new categories—all funded by its robust cash flow, which has allowed it to remain virtually debt-free.

Dixon’s excellence in execution comes from its deep understanding of electronics manufacturing, comprehensive backward integration for the lowest Bill of Materials (BOM) costs, cutting-edge R&D centres, well-established processes, and world-class manufacturing facilities.

Lean business model: Dixon adheres to a high-volume, low-mix (HVLM) business model. The HVLM business model is a strategic approach particularly effective in industries like electronics manufacturing, where scale can significantly drive down unit costs.

View Full Image

Is ₹1 trillion in sight?

As we dig into Dixon Technologies’ prospects, a key question emerges: Where is the stock price headed?

Given the company’s solid track record and HVLM business model, similar to industry giants like Foxconn, we can expect some steady movements. Notably, these big players often operate with net margins around 2.5%, and Dixon is likely to follow a similar pattern. Given the robust growth in the mobile phone segment—a major revenue source for Dixon—it’s reasonable to expect these margins to stay consistent over the next five years.

Looking at the broader picture, the industry’s growth rate north of 30% suggests that Dixon could maintain or even expand its market share in key segments. This positions the company to potentially boost its revenue growth to around 35%, with Ebitda and PAT growth possibly reaching 40%, thanks to scaling efficiencies in newer markets.

With this growth, Dixon is poised to generate substantial cash flow, which should allow it to fund expansion efforts while maintaining a debt-free balance sheet.

By FY30, if we stick to our earlier general estimate of a 40% increase in net earnings, Dixon’s PAT could hit about ₹2,900 crore. Using a forward price-to-earnings (PE) ratio of about 40x, Dixon’s market valuation might rise to approximately ₹112,943 crore—marking a 36% growth from its current levels.

All we have done here is make broad assumptions; these are not research estimates and should be treated as such.

However, these numbers, which are anyway based on broad assumptions, aren’t without their caveats.

The assumed PE of 40x takes into account that the market segments Dixon operates in might mature, leading to a slower growth phase and a lower PE, similar to what we see with Foxconn in more developed markets. It’s possible Dixon’s PE might adjust downwards as the Indian industry matures.

Furthermore, while Dixon is thriving in a thin-margin industry, the potential for significant margin expansion is limited. Competition is likely to keep margins tight, possibly between 2.3% and 2.8%, even in the long term.

It’s also worth noting that the market may have already priced in much of Dixon’s future growth, given the stock’s significant rise. With all these factors at play, predicting substantial future gains from current levels could be challenging.

To sum up, Dixon Technologies is on a promising path to potentially boost its market value significantly, driven by strategic initiatives and a solid presence in the electronics manufacturing sector.

However, as the industry continues to evolve, it’s important for Dixon to navigate new opportunities wisely. While the potential for growth is evident, the future will require careful strategy and adaptability.

Dixon’s journey ahead is filled with possibilities, but like any business venture, it comes with its share of uncertainties.

Note: We have relied on data from annual reports, industry reports, and DRHPs of other EMS players for this article. For forecasting, we have used our assumptions.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only. The views expressed are my own and do not reflect or represent the views of my present or past employers.

Parth Parikh has over a decade of experience in finance and research, and he currently heads the growth and content vertical at Finsire. He has a keen interest in Indian and global stocks and holds an FRM Charter along with an MBA in Finance from Narsee Monjee Institute of Management Studies. Previously, he has held research positions at various companies.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.