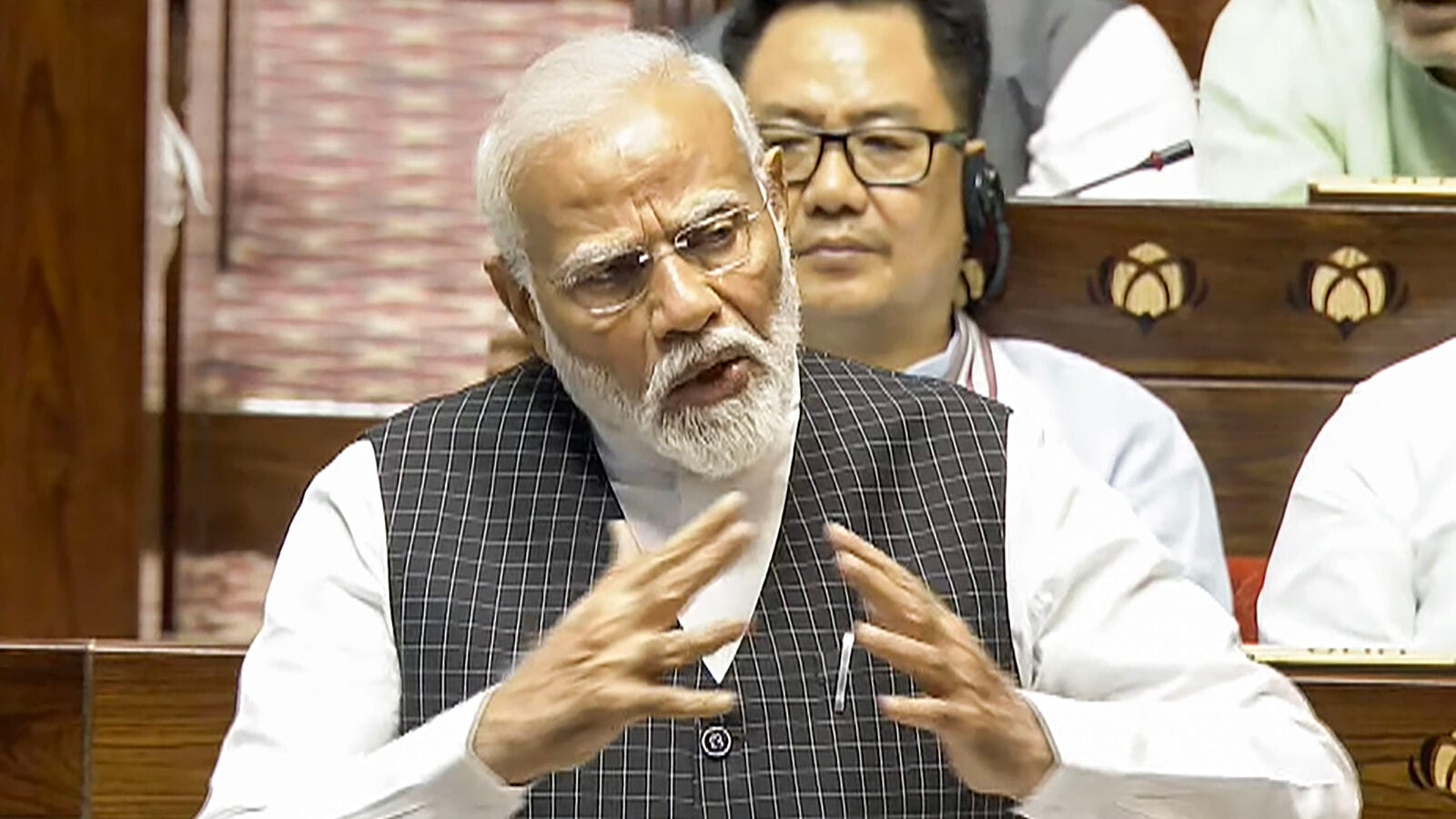

Budget 2024 Expectations Live Updates: Prime Minister Narendra Modi is set to engage with prominent economists and sectoral experts. A senior government official disclosed that the meeting aims to gather insights and recommendations for the 2024-25 Budget, which Union Finance Minister Nirmala Sitharaman will present in the Lok Sabha on July 23.

This Budget is poised to be a critical economic blueprint for the Modi 3.0 administration, outlining key fiscal policies and initiatives. The consultation will see the participation of Niti Aayog Vice Chairman Suman Bery, along with other distinguished members, as the government seeks to integrate diverse expert perspectives into its financial planning.

Budget 2024 Expectations Live Updates: Pre-budget deliberations are crucial for focusing on smart financial planning, especially regarding taxes, says expert

Jyoti Bhandari, Founder and CEO, Lovak Capital, said, “Delving into economic echoes and navigating past trends to forecast future fiscal terrain with insightful reflections is crucial. Pre-budget deliberations are crucial for focusing on smart financial planning, especially regarding taxes. With potential new tax regulations on the horizon, individuals and businesses need to adjust their financial strategies proactively. To continue the current momentum and enthusiasm amongst investors, the MFI association has suggested bringing uniform tax slabs in the various asset classes. For instance, they have advised removing the tax element for the switch transaction, bringing uniformity in taxation for investments in gold funds and physical gold, and making PMS and AIFs more tax-efficient for investors. We believe the pre-budget season goes beyond numbers; it’s about creating a personalized financial plan for sustainable growth. Through a thorough analysis of possible fiscal changes and strategic adjustments, we are dedicated to guiding our clients toward a future strengthened by financial prudence. By implementing effective tax management strategies tailored to the Indian context, we help our clients optimize their finances while reducing tax burdens. We are committed to supporting our clients through this important phase, setting them up for success in the upcoming fiscal year.”

Budget 2024 Expectations Live: Healthcare experts calls for exemptions focused on mental health

Saurav Kasera, Co-founder and CEO, CLIRNET and DocTube, said, “As the burden of non-communicable diseases (NCDs) increases exponentially, the upcoming Union Budget must prioritize higher fund allocation and increase deductions for individual taxpayers for primary, preventative, and mental healthcare. Enhanced investment in these areas is crucial to reduce the overall healthcare burden and pressure on tertiary facilities. Furthermore, to incentivize SMEs to provide health insurance to all their employees, the government should offer an Input Tax Credit (ITC) on GST for health insurance expenses, which is currently not available to everyone. This will encourage SMEs to invest in employee health, leading to a healthier workforce and reducing the overall healthcare burden. Additionally, the healthcare sector needs a significant upgrade in its skilled workforce. Increasing funds and incentives for the training of nurses and other paramedical staff is essential to improve healthcare delivery and meet the growing demand for skilled professionals.”