But can this approach succeed in the diamond industry, where exclusivity is often the main attraction?

Over the past three years, Trent has achieved impressive growth, with sales and profits rising at compound annual growth rates (CAGR) of 68% and 103%, respectively. During this period, its share price grew at a CAGR of 90%, pushing its price-to-earnings ratio to an impressive 202. This momentum stemmed largely from capitalizing on the shift from unorganized to organized retail and embracing India’s fast-fashion trend.

Read this | Power Play: Kamaths unlock new level with investment in gaming stock

Targeting the under-served mass-market segment with clothing priced under ₹1,000, Trent rapidly expanded its Zudio brand in smaller cities. Unlike premium-focused competitors, Trent’s disruptive strategy has found success in the lower-cost, fast-fashion space.

Now, Trent’s ambitions extend even further. Alongside international expansion, it has recently ventured into the lab-grown diamond market with its brand, POME, available at select Westside stores. This move signals Trent’s intent to disrupt another fast-growing category by positioning LGDs as affordable alternatives to natural diamonds.

The question remains: can Trent replicate its success in the diamond industry?

Lab-grown diamonds: A market in transition

Lab-grown diamonds, produced in controlled environments that mimic natural processes, offer an affordable option for consumers.

However, there’s one major difference between LGDs and natural diamonds: the price. LGDs cost just 6-10% of natural diamonds, making them far more affordable. Although LGDs hold limited resale value compared to natural stones, their affordability has made them increasingly popular.

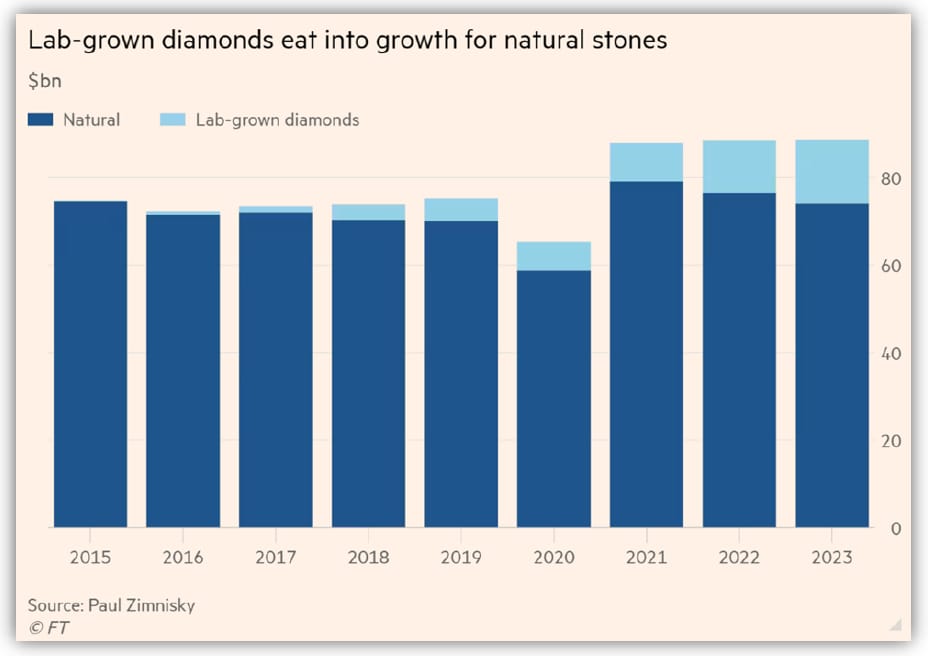

LGDs have been steadily capturing market share from natural diamonds. According to a Financial Times report, LGDs’ global market share surged from 3.5% in 2018 to 16.5% in 2023, with Forbes projecting it to reach 21.3% by next year. While natural diamond sales have stagnated since 2015, LGDs continue to carve out their space.

View Full Image

China, India, and the US are the primary producers, with China leading at 12.7% of global LGD supply in 2024, followed by India at 2.9%. In India, the LGD industry was valued at $0.26 billion in 2022, growing at a CAGR of 10.6% from 2018 to 2021. It is projected to grow at 14.8%, from $0.3 billion in 2023 to $1.2 billion by 2033.

The global LGD market produced 40 million carats in FY24, and its market value is expected to grow at a CAGR of 10%, reaching $50 billion by 2030. This remains modest compared to the $89 billion natural diamond jewellery market.

Read this | Nifty falls below 24,000. Here are two stocks for your watchlist

India is a significant player in LGD production, with Mumbai and Surat (the “Diamond City”) producing 16 million carats out of the global 40 million in FY24, according to the Global Trade Research Initiative (GTRI). However, despite being the world’s second-largest LGD producer after China, domestic consumption in India remains low compared to markets like the US and Europe.

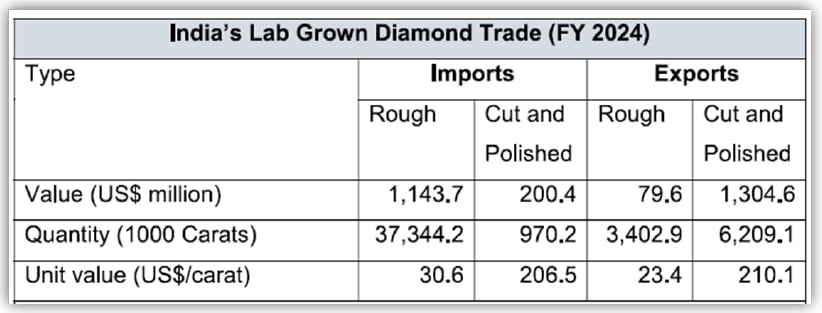

As a result, the Indian LGD industry relies heavily on exports for revenue. In FY24, India imported $1,384 million worth of LGDs and exported $1,344 million, primarily catering to foreign demand. However, as affordability and quality continue to draw interest, domestic demand for LGDs is also on the rise alongside growth in the global market.

Challenges in the LGD industry

Despite its rapid growth, the LGD industry faces substantial challenges, with its key selling point—low cost—now working against it.

Initially, LGDs’ affordability made them a mass-market alternative to natural diamonds. However, part of natural diamonds’ appeal lies in their exclusivity, a value that diminishes when everyone can afford the product.

The domestic LGD industry also grapples with issues of oversupply, unchecked production, and tumbling prices. A lack of regulation allows continuous imports despite an existing surplus, intensifying price pressures.

In FY24, India imported $1,144 million in rough diamonds and exported $1,305 million in cut and polished LGDs, primarily to markets like Hong Kong and the UAE. However, domestic demand has not kept up, leading to a steep 65% drop in prices—from ₹60,000 to ₹20,000 per carat. For perspective, natural diamonds remain priced well above ₹500,000 per carat.

View Full Image

The oversupply problem isn’t confined to India. Globally, LGD prices have dropped around 70% from over $5,000 per carat in 2016 to $1,425 in 2023. Meanwhile, natural diamonds face dwindling sales due to competition from LGDs, pushing their prices down over 25% to an eight-year low of $5,185 per carat.

The situation is squeezing producers, especially those reliant on financing, and may push several LGD manufacturers and jewellery retailers toward bankruptcy. Some experts, however, believe that competition will ease over time, allowing the industry to eventually stabilize.

Indian companies in the fray

Now, let’s take a closer look at the Indian companies venturing into the lab-grown diamond (LGD) market.

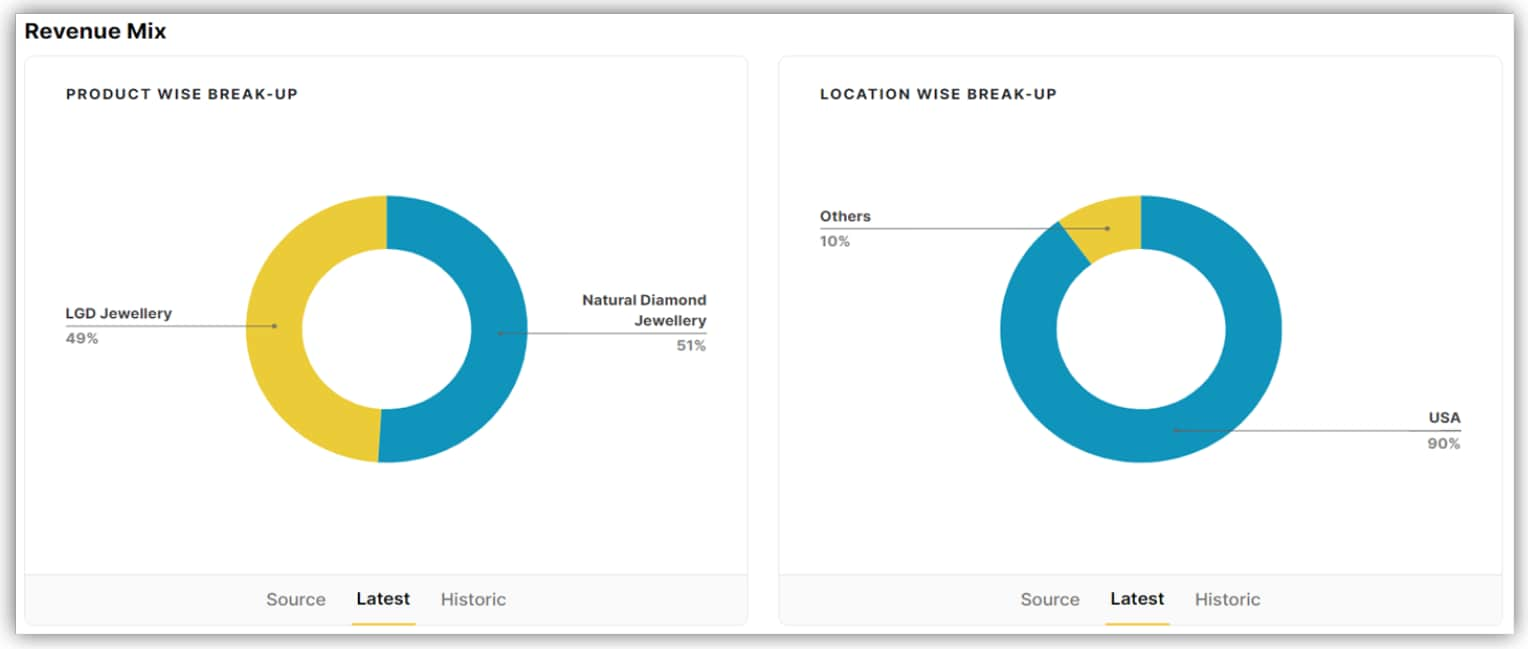

Goldiam International, a prominent diamond jewellery exporter with three decades of experience, stands out as one of the first to grow, manufacture, and distribute LGD jewellery in-house. Currently, it’s the largest listed LGD company, with LGDs contributing 49% of its total revenue, while the rest comes from natural diamond jewellery.

View Full Image

Goldiam’s primary revenue stream remains exports to the US, where it holds a low-single-digit market share. Given the immense growth potential in the LGD space, this share leaves significant room for expansion.

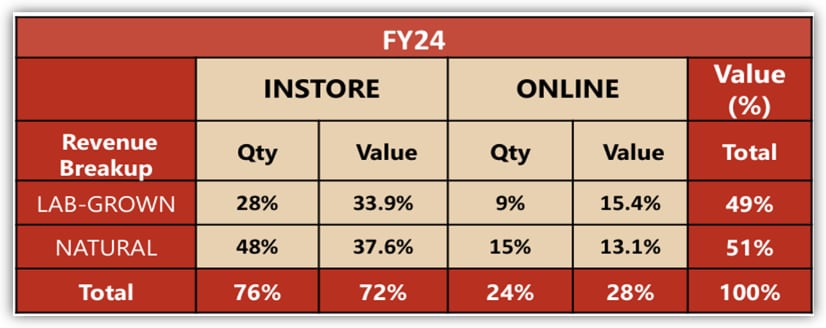

The company’s revenue from LGDs has surged, climbing from 21% last year to 49% in FY24, likely benefiting from consolidation as other players face industry challenges.

View Full Image

Recognizing the domestic opportunity, Goldiam recently launched “ORIGEM,” its LGD jewellery retail brand in India. With plans to open three to five ORIGEM stores in Q3FY25 and expand to 15 by the end of Q1FY26, Goldiam aims to become a major LGD player within India.

Goldiam’s current order book stands at ₹2 billion, predominantly LGD orders, scheduled for export by the end of calendar year (CY) 2024, per media reports. With LGD prices already at record lows, a potential price recovery could further boost the company’s profitability.

Financially, Goldiam has performed well, with revenue increasing from ₹4.1 billion in FY21 to ₹6.0 billion in FY24, and profits rising from ₹0.61 billion to ₹0.91 billion. Yet, it trades at a lower valuation than peers like Titan, Kalyan, and the newly listed PN Gadgil, which indicates potential for re-rating if Goldiam continues to capitalize on the LGD opportunity and the industry finds a demand-supply equilibrium.

Another notable entrant is Senco, which recently incorporated SENNES Fashion LTd, a wholly-owned subsidiary, to broaden its offerings. Senco’s new division will trade, export, and import lifestyle products, including LGD jewellery, which it expects to contribute around 5% to revenue in the next four to five years.

Then there’s Trent’s brand, POME, which is testing the LGD market with a mass-market focus. By positioning its one-carat solitaire engagement rings between ₹13,000 and ₹17,000—30% below the price of comparable natural diamond jewellery and 80-85% below premium pieces—POME is eyeing value-conscious consumers. This strategy also supports Westside in driving higher average sales per store.

With gross margins of 45-50%, POME reportedly keeps Trent’s overall gross margin healthy at around 45%. However, Trent’s current valuation leaves limited room for error, reflecting high market expectations.

But why Trent and not Tanishq?

While Trent has ventured into LGDs, Tanishq, another Tata brand, remains firmly rooted in the natural diamond segment. Recently, Tanishq partnered with De Beers, the world’s largest diamond producer, to reinforce its commitment to natural diamonds and enhance their appeal to consumers.

Why not LGDs? Titan Company’s managing director, C.K. Venkataraman, indirectly addressed this in the August earnings call, noting that natural diamonds, like luxury cars and homes, symbolize affluence. In his view, affluent consumers are unlikely to gravitate toward LGDs, which are perceived as a “poor man’s product”—a fashion accessory rather than a valuable, enduring asset.

Studded jewelry contributed 33% to Titan’s overall jewelry revenue and nearly half of its operating profit in Q4FY24, making the focus on natural diamonds a strategic priority. This positioning has driven a strong share price re-rating over the last four years, climbing from ₹68 in 2021 to its current ₹358, with a price-to-earnings multiple expansion from 17 to 40.

View Full Image

For now, Tanishq’s core segments—especially wedding jewellery—appear well-insulated from LGDs. Tanishq’s customer goodwill, strengthened by robust buyback policies, likely offers a cushion against any potential erosion in market share. However, as reported, LGDs could pose competition to Titan’s daily-wear lines under Mia and CaratLane, areas where Trent’s new LGD brand, POME, is actively targeting price-sensitive consumers.

Trent’s strategy banks on the notion that, much like their American counterparts, Indian consumers view LGDs as fashionable but non-asset jewellery. POME is tailored to appeal to Westside’s fast-fashion customers, offering them a chic, affordable alternative to natural diamonds.

Tanishq isn’t alone in sidestepping the LGD segment. Other prominent jewellery brands, including Kalyan, Malabar, and Joyalukkas, have also opted out, citing low demand and a reluctance to mix LGDs with natural stones in their stores.

For more such analysis, read Profit Pulse.

According to a report, these retailers believe India isn’t yet ready for LGDs, viewing them more as fashion jewellery than valuable assets with resale potential.

In the end, Tata’s approach—deploying separate brands to capture the LGD and natural diamond markets—may allow it to harness both opportunities. Should this strategy prove successful, Trent might have yet another mass-market success on its hands, further justifying its premium valuation.

Note: This article relies on data primarily from Screener.in and Tijorifinance. Where unavailable, alternate widely accepted sources were used.

The purpose of this article is to share intriguing charts, data points, and thought-provoking insights. It is not an investment recommendation. Please consult your advisor before making any investment decisions. This article is intended for educational purposes only.

Madhvendra, a seasoned financial content writer with over seven years of experience, has been a passionate follower of the equity market. He enjoys reading and sharing his candid views on publicly listed Indian companies and macroeconomic trends.

Disclosure: The author holds a position in the stock discussed in this article.