This programme entails an investment in a US project, generally in real estate, that generates at least 10 jobs. To participate, investors must work with asset managers called “regional centers” (RCs) that are recognized by US Citizenship and Immigration Services (USCIS). Some of these RCs have offices or representatives in India, making the process accessible to Indian investors.

The RCs offer developers in the U.S. access to low-cost funding, which is a win-win for the Indian investor and the developer. One can also directly invest in a project that qualifies for the EB-5 programme, but direct investment is highly risky. It is best avoided, according to immigration experts that Mint spoke to.

“Generally, parents invest in EB-5 for their children either studying in the US or have just graduated. More importantly, it is a very well-defined path to US residency (Green Card) for individuals who intend to build a career in the US post college,” said Arindam Sengupta of Edufund.

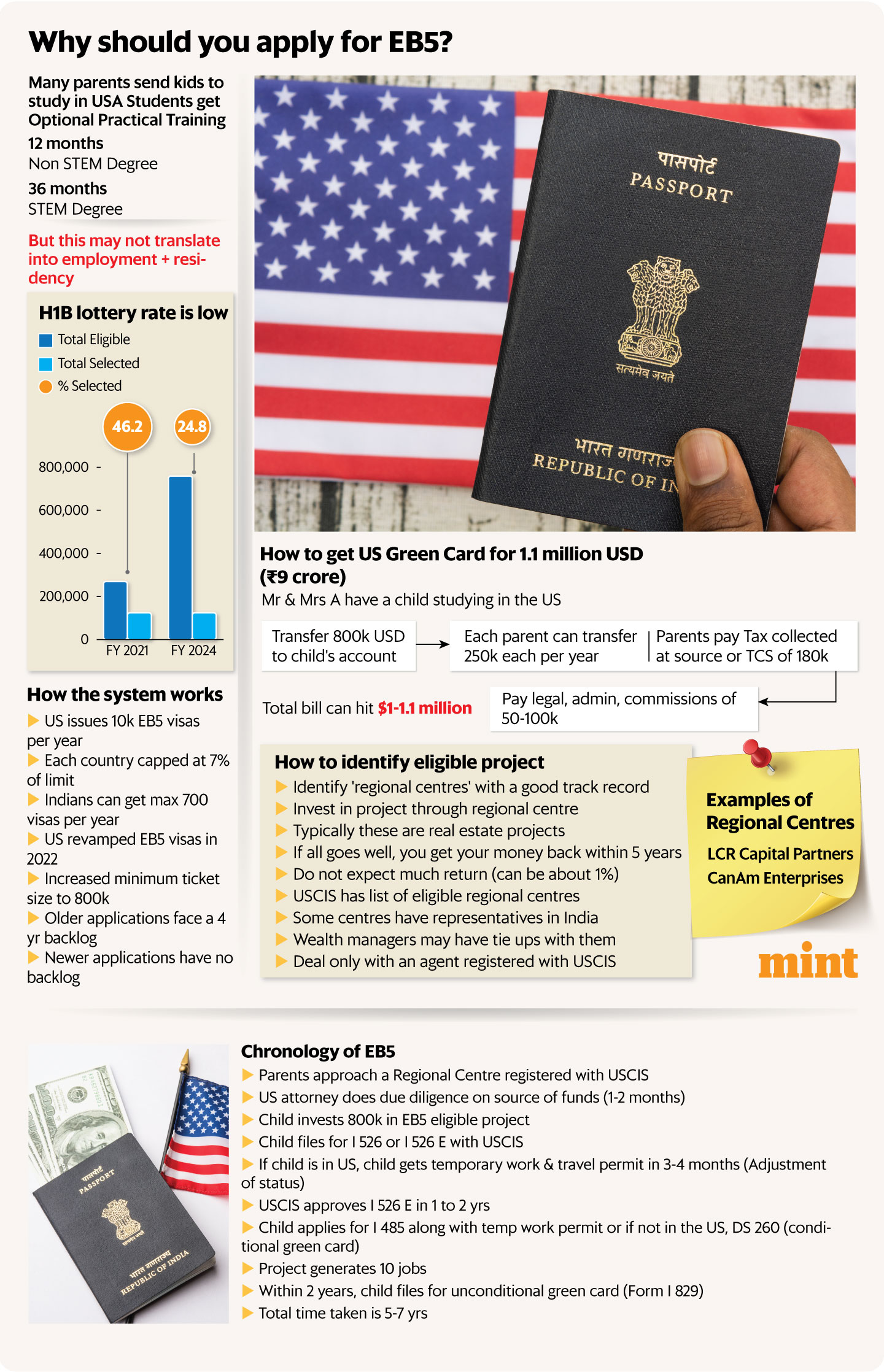

“Students in US colleges get to do optional practical training or OPT for one to three years after graduation, depending on the type of degree programme. Essentially, they can work for a few years. However, after that they must get an H1B visa to keep working and the H1B system is a lottery with a limited chance of getting a visa even if you find an employer. This is why many HNI parents in India opt for the EB-5 route,” added Sengupta, who runs a wealth management business focused on education and also does EB-5 consultancy.

View Full Image

The EB-5 programme has seen backlogs, particularly for applications submitted under the old version of the programme, with some applications dating back to 2021. However, the new version of the programme, launched in 2022, is not backlogged, especially for “rural projects” in areas of the US with a population below 20,000.

The US issues 10,000 EB-5 visas annually, with a maximum of 7% allocated to each country. This means that Indian passport holders can receive up to 700 visas per year. While the quota for applicants from China is often oversubscribed, the new EB-5 quota for India remains available but may fill up in the coming months.

How the finances work

The cost of participating in the EB-5 programme is $800,000, an increase from the previous $500,000 under the revamped 2022 programme. Under the RBI’s Liberalised Remittance Scheme (LRS), individuals can remit up to $250,000 per year. A married couple can combine their remittances to reach $1 million by making transfers in March and April, taking advantage of two financial years in a period of two months. The funds can be transferred to a child’s account in the US as a gift, allowing the child to invest in an EB-5 project.

“Before you invest, do ensure that your source of funds has been vetted by a competent US EB-5 specialist immigration attorney,” said Shilpa Menon, senior director at LCR Capital Partners, a US-based private investment and advisory services firm that manages EB-5 funds under the regional centre programme.

“The immigration attorney should be independent and not affiliated with any Regional Center or registered agent. After you select and invest in a project, your attorney will file the I-526E (EB 5 petition) along with your source of funds documents, project documents and proof of investment. Typically, the USCIS takes 12-18 months to approve the petition, depending on the type of project you invest in,” Menon added.

Upon approval, the investor can apply for a conditional green card using Form I-485 if the child is already in the US, or DS-260 if outside the country. While waiting for the I-526E approval, the child may be eligible for a temporary work and travel permit, which can be obtained within two-three months.

If the project generates at least 10 jobs, an application for an unconditional green card can be submitted within two years using Form I-289. After you get it, the investment can be redeemed, subject to the lock-in period imposed by the regional centre.

Also Read: Beyond borders: Essential finance tips to ease path of Indians moving abroad

A list of approved regional centers is available on the USCIS website. It is advisable to consult a wealth manager or specialized immigration lawyer in the US who has connections in India. Including various legal fees, the total cost of the EB-5 programme may increase by an additional $50,000 to $100,000. Additionally, investors must pay a 20% tax collected at source (TCS) on the remitted funds, which can be adjusted against their tax liability or claimed as a refund when filing their income tax return. Including the TCS, the total upfront cost for the EB-5 program amounts to approximately ₹9 crore or $1.1 million.

What to watch out for

Families considering the EB-5 programme should be prepared for thorough checks and due diligence, an investment advisor who declined to be named told Mint. The regional centre will suggest US-licensed immigration lawyers who will check the source of funds, requiring a paper trail that confirms the legitimacy of the the funds. Background checks, including a review of criminal history, are also part of the vetting process, which can take two to three months.

It is important to ensure that the agent involved is registered with USCIS and that the regional center is large and well-established. This increases the likelihood of getting the initial I-526E approval and the conditional visa. Otherwise, you may not be able to show you’ve generated at least 10 jobs, and you may not get your money back. Sometimes, the project might fail, but you will get your money back. The best outcome is getting your visa and money back.

Once the conditional green card is obtained, the applicant must travel to the US and cannot stay outside the country for more than 180 days at a stretch. This requirement can be met by making multiple trips per year. The green card is granted to the child, spouse, and children, but not to parents unless they apply separately.

Also Read: Investing in India from abroad: Navigating financial hurdles for NRIs