NEW DELHI

:

Insurance is the first step towards financial planning. We buy policies to insure ourselves against unfortunate events. However, having insurance does not always guarantee protection.

Claim requests are often rejected, citing non-disclosure of pre-existing diseases, lifestyle habits, or having multiple policies.

Most of the time, policyholders are caught unawares as it’s an age-old practice in the insurance business to bury disclosure requirements in the fine print.

View Full Image

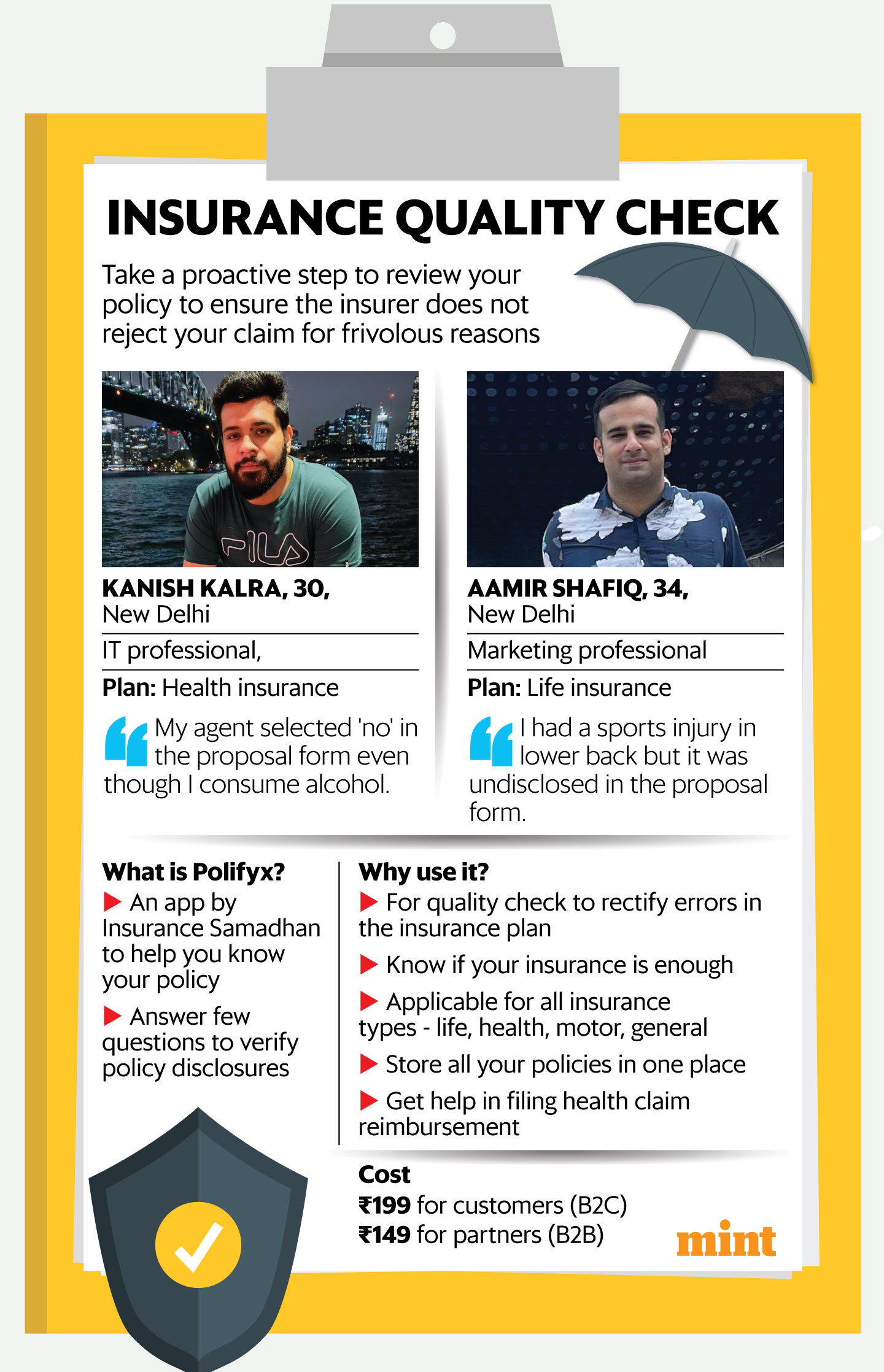

Besides, sometimes insurance agents do not disclose complete information in the proposal form despite clients’ insistence. This happened with New Delhi-based IT professional Kanish Kalra, 30. Luckily, he ran a quality check and discovered that material information was missing in his policy.

“I got to know about an app called Polyfix by Insurance Samadhan. I uploaded my health insurance policy document on the app. It fetched my policy details and asked me questions about my health and habits. It alerted me that even though I consume alcohol, it was not mentioned in the proposal form. I had told my agent to do it. I connected with the insurer and got it rectified,” said Kalra.

New Delhi-based marketing professional Aamir Shafiq, 34, did it for his life insurance policy. “I have an alignment issue on the lower back due to a sports injury from football. This information was missing in the policy document. The app identified it because I mentioned it in the app during the quality check,” said Shafiq.

The premium slightly increased for Kalra and Shafiq after their disclosures.

In some cases, the disclosure may also lead to the cancellation of the policy. Nevertheless, it is better than paying premiums and facing claim rejection when the time comes.

What is Polyfix?

Insurance Samadhan, a tech-based insurance grievance redressal platform, launched Polyfix in April 2023 to help policyholders identify errors and omissions in the proposal form so that they do not face claim rejection in the moment of truth.

“We assist policyholders in case of miss-selling, if their claims get rejected or short-settled. We have come up with a solution now in which they can proactively fix errors in their policy, if any. We also tell them if their insurance is enough or if they need more based on their income and family responsibilities. We don’t sell insurance or any other financial products,” said Deepak Bhuvneshwari Uniyal, co-founder and chief executive of Insurance Samadhan.

The app’s ‘know your policy’ feature costs ₹199 for customers (B2C) and ₹149 for partners (B2B). It is available for all types of insurance.

How it works

All one has to do is upload the PDF or the image of one’s policy pack. It must include your proposal form. The app fetches your policy details such as proposal number, company name, premium paid and medical underwriting, lifestyle details like smoking, drinking and income, contact information and nominee details. It further prompts you to answer a few questions. Your answers are essential, against which it verifies if disclosures made in your policy align with it. If something does not match up, it alerts you in the final step. It also tells you if the missing information is ‘high impact’ or ‘low impact’ to the claim settlement.

“We bifurcate all critical information into four sections: personal, contact, nominee and policy details, including medical and financial underwriting details. We prompt customers accordingly if something is missing,” Uniyal said.

Interestingly, the app drafts a mail on your behalf that you can directly send to the insurance company to rectify your policy. “The customer does not have to look for the insurance company’s contact. We have it stored for all insurers,” Uniyal added.

Among other features, the ‘digital vault’ allows you to store all your policies in one place. The app also has a feature called ‘health claim reimbursement’ that can help you file claims professionally to avoid back-and-forth or claim rejection for frivolous reasons.

While it is a good idea to verify policy details via Polifyx, ensure that you always disclose all pre-existing diseases and lifestyle habits such as smoking and drinking in the proposal form. Disclose details of related policies as well.