By expanding into new markets, products, or services, businesses can mitigate risks associated with economic downturns, industry shifts, and unforeseen challenges.

The data centre industry stands as a prime example of this trend.

India has emerged as a global hotspot for data centre investments, fuelled by increasing digital adoption and favourable government policies.

With a projected capacity addition of 850 MW by 2026, the country is poised to become a dominant player.

This rapid growth is attracting a diverse range of players, including established industry giants and newcomers.

Seizing this opportunity, Castrol India has also ventured into this burgeoning market.

Before dwelling further on why Castrol entered the data centre space, here’s a brief overview of the company.

About Castrol India

Castrol India, a prominent subsidiary of the global lubricants brand Castrol and part of BP (British Petroleum), has been a significant player in the Indian lubricant industry since 1910.

Headquartered in Mumbai, Castrol India specialises in manufacturing and marketing a wide range of automotive and industrial lubricants.

Its product portfolio includes engine oils, transmission fluids, and speciality products for various vehicles, as well as oils and greases for industrial applications.

The company is well-regarded for its strong market presence and quality offerings, with notable brands such as Castrol GTX, Castrol Edge, and Castrol Activ.

Leveraging global R&D capabilities, Castrol India invests in technological advancements to develop innovative lubrication solutions that meet industry standards and customer needs, including improvements in fuel efficiency and engine protection.

The Mega Opportunity

Castrol India, a renowned name in the lubricant industry, is setting its sights on data centres as a significant new growth avenue.

This strategic move aligns with Castrol’s global vision, which has identified data centre thermal management as a key area for future participation.

The rapid expansion of data centres, driven by the increasing demand for cloud services, AI, and big data, has created a pressing need for advanced cooling solutions.

Castrol India is leveraging its deep expertise in fluid technology to develop innovative products that meet these demands.

With data centres projected to become some of the largest consumers of energy worldwide, efficiency and effective thermal management will be critical.

Castrol’s leadership, including CEO Sangwan, believes this sector will require solutions that support operations at much higher speeds and capacities.

Strategic Data Centre Solution Investment

To support its expansion into the data centre industry, Castrol has made significant investments in research and development.

The company has established a state-of-the-art R&D centre at its global headquarters in the UK, with Castrol BP investing approximately 15 million pounds into this facility.

This centre is dedicated to developing and refining advanced solutions specifically tailored for data centres, focusing on improving energy efficiency and minimising environmental impact.

The R&D centre is a cornerstone of Castrol’s broader strategy to diversify its offerings and penetrate new markets.

Castrol aims to address one of the most critical challenges facing data centre operators today: the need to effectively manage heat generated by increasingly dense and powerful hardware.

This strategic investment underscores Castrol’s commitment to innovation and positions the company as a key player in the rapidly evolving data centre industry.

From EVs to Data Centers: The Big Shift

While Castrol continues to monitor the growth of the electric vehicle (EV) market, the company is pragmatic about the pace of this transition.

Castrol currently supplies lubricants to two of the largest original equipment manufacturers (OEMs) in the car segment, and while this business is expected to scale up, the company anticipates it will take another 5-6 years before it becomes a major revenue driver.

In contrast, the data centre industry presents a more immediate and lucrative opportunity.

Recent advancements have highlighted the potential of liquid cooling techniques as an alternative to traditional air cooling systems, which are increasingly inefficient as rack densities grow.

With the rise of AI and machine learning, data centres are being equipped with more powerful components like GPUs, which generate significantly more heat.

Liquid cooling, being more effective at heat dissipation than air, is gaining traction as a solution to reduce emissions and lower energy costs.

Despite some resistance to adopting these new cooling techniques, interest in liquid cooling is growing.

Castrol sees a huge opportunity to diversify into industrial thermal solutions for data centres, recognising the sector’s potential for significant growth.

A Close Look at Financials

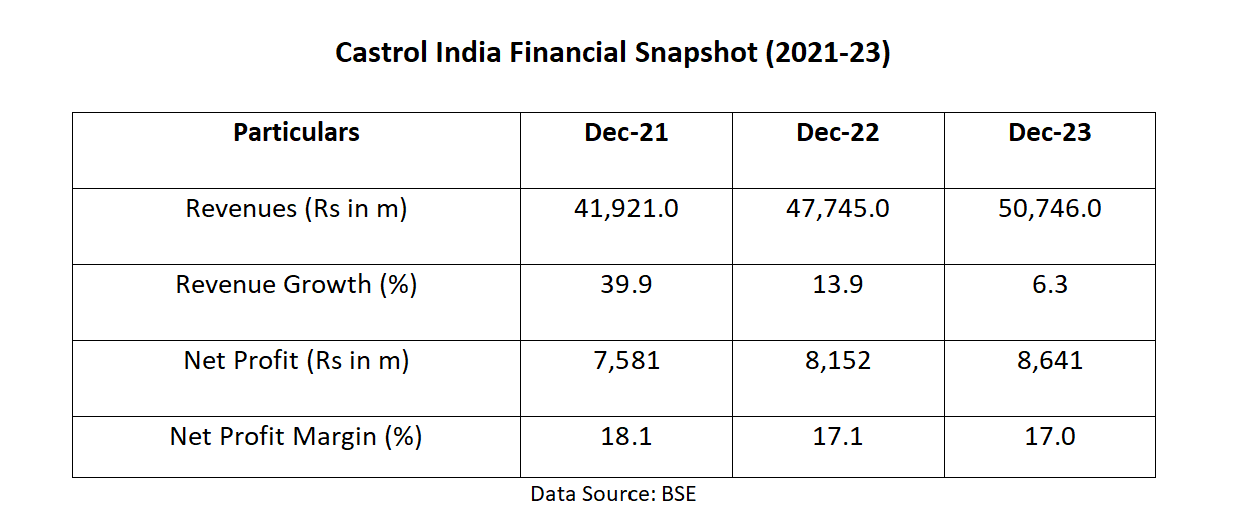

Castrol India’s revenue has grown steadily over the past three years at a compound annual growth rate (CAGR) of 10.5%, but the growth rate has slowed down.

From a strong growth rate of 39.9% in December 2021, the growth slowed to 13.9% in December 2022 and further to 6.3% in December 2023.

This trend suggests that while Castrol India continues to expand its sales, the pace of growth is slowing.

Meanwhile, the net profit has been consistently increasing over the three year at CAGR of 6.7%.

The consistent increase in net profit highlights Castrol India’s effective cost management and operational efficiency.

View Full Image

Meanwhile, for the June 2024 quarter, the company reported a 5% YoY rise in revenue to ₹13.9 billion, against ₹13.3 billion a year back.

Meanwhile, its net profit grew by 3.1% to ₹2.3 billion as the continuing rise in vehicle sales boosted its mainstay business of automobile lubricants and helped offset the rise in costs.

Conclusion

The Indian data centre market is projected to reach a valuation of $21.8 bn by 2032, up from $7.2 bn in 2023, reflecting a robust CAGR of 13.37% during the forecast period from 2024 to 2032.

India is rapidly emerging as a key hub for data centres, driven by significant factors and strong growth statistics.

The rollout of 5G networks is expected to significantly boost data consumption, with Indian users increasingly engaging in online OTT content, gaming, shopping, smart home automation, and online security cameras.

This surge in data usage demands advanced data centre infrastructure.

The capacity of tier 3 data centres is projected to grow from 888.5 MW in 2022 to 3,365.0 MW by 2029, while tier 4 data centres are expected to expand from 211.9 MW in 2022 to 1,380.2 MW by 2029.

Additionally, India’s overall data centre capacity is anticipated to double from 0.9 GW in 2023 to approximately 2 GW by 2026.

Major investments highlight this growth, with AWS planning to invest $12.7 bn by 2030, Google committing $10 bn to the India Digitization Fund, and Walmart investing over $2.5 bn in 2023 alone. These investments underscore India’s strategic importance as a growing centre for data centres and digital infrastructure.

As the demand for cooling solutions intensifies in line with this growth, Castrol India is well-positioned to capitalize on this opportunity, aligning its expertise in fluid technology with the expanding needs of the data centre market.

Nevertheless, it is always prudent to conduct thorough research before making any investment decisions.

Ensure that the investment aligns with your financial objectives and matches your risk tolerance level.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com