With its retail portion being fully subscribed within a few hours of opening, JG Chemicals IPO had a great start on its first day of subscription. Eventually, the issue has been fully subscribed on the first day of opening. JG Chemicals IPO subscription status was 2.47 times, as per BSE data.

Also Read: JG Chemicals IPO oversubscribed: GMP, subscription status to review. Should you apply?

JG Chemicals IPO’s retail investors portion has been subscribed 3.64 times, Non Institutional Investors (NII) portion is booked 2.90 times, and Qualified Institutional Buyers (QIB) portion is booked 2%.

It has reserved not more than 50% of the shares in the public issue for qualified institutional buyers (QIB), not less than 15% for non-institutional Institutional Investors (NII), and not less than 35% of the offer is reserved for retail investors.

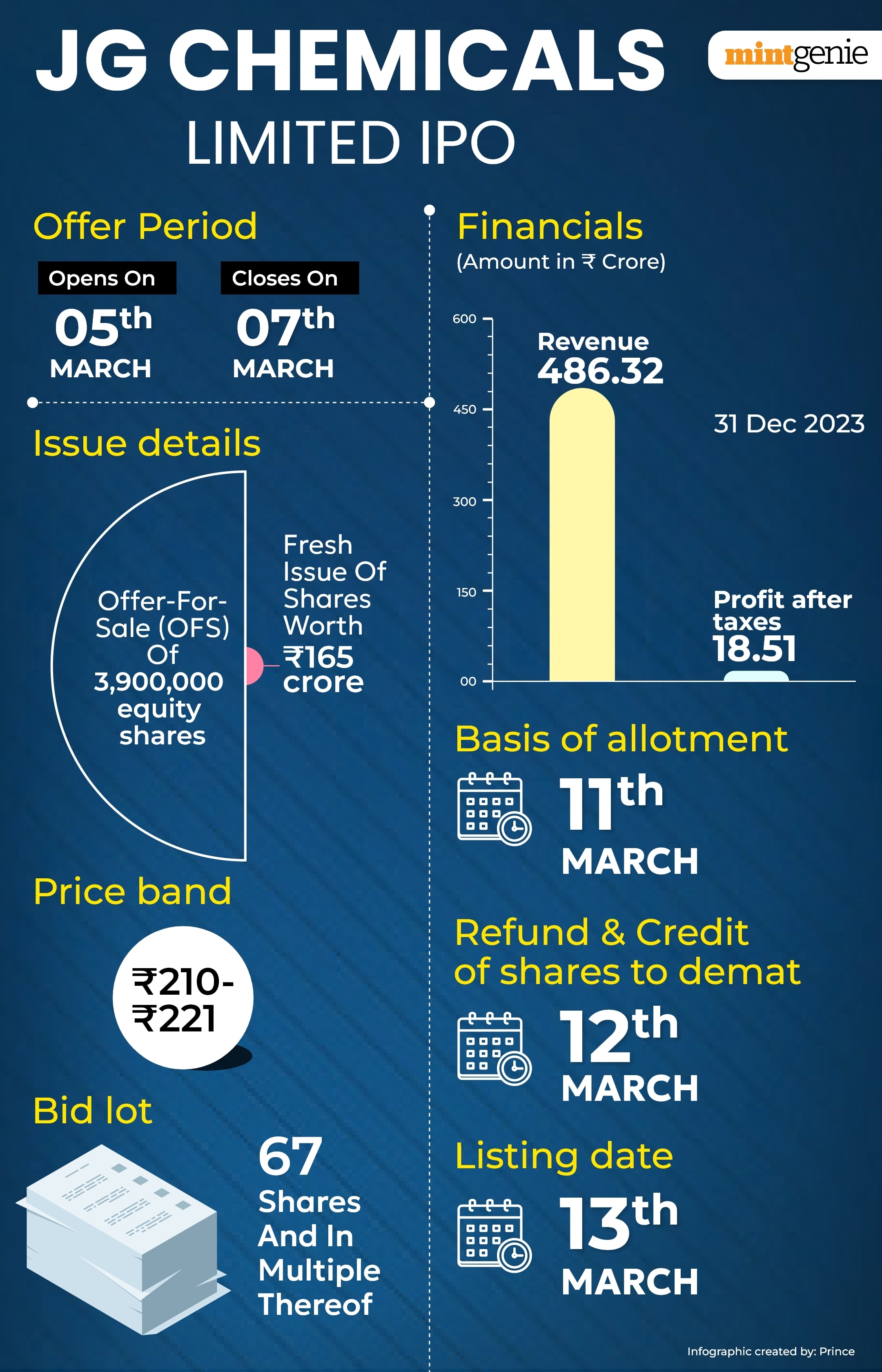

JG Chemicals IPO opens for subscription on Tuesday, March 5, and will close on Thursday, March 7.

Also Read: JG Chemicals IPO to open tomorrow: GMP, issue details, 10 key things to know before investing to ₹251.19-crore issue

“Exciting news! Mint is now on WhatsApp Channels ???? Subscribe today by clicking the link and stay updated with the latest financial insights!” Click here!

View Full Image

JG Chemicals IPO price band has been set in the range of ₹210 to ₹221 per equity share of the face value of ₹10. Investors can bid for a minimum of 67 equity shares and in multiples of 67 equity shares thereafter. JG Chemicals raised ₹75.35 crore from anchor investors on Monday, March 4.

In terms of both output and income, JG Chemicals is India’s largest manufacturer of zinc oxide, according to the Red Herring Prospectus (RHP).

The firm is one of the top 10 producers of zinc oxides worldwide and distributes more than 80 grades of the metal.

Also Read: JG Chemicals IPO: Issue fully booked on day 1 on strong retail interest. Check GMP, other key details

Numerous industrial sectors, including the rubber sector (tyres and related products), ceramics, paints and coatings, pharmaceuticals and cosmetics, electronics and batteries, agrochemicals and fertilisers, specialty chemicals, lubricants, oil and gas and animal feed, use the company’s products.

As per the RHP, the company’s listed peers are Rajratan Global Wire Ltd ( with a P/E of 33.43), NOCIL Ltd (with a P/E of 30.97), and Yasho Industries Ltd (with a P/E of 30.03).

Between March 31, 2022, and March 31, 2023, JG Chemicals Limited’s profit after tax (PAT) climbed by 31.69%, while its sales increased by 27.47%.

JG Chemicals IPO subscription status

JG Chemicals IPO has received bids for 3,63,27,802 shares against 81,68,714 shares on offer, at 13:06 IST, according to data from the BSE.

The retail investors’ portion received bids for 2,55,54,135 shares against 41,15,000 shares on offer for this segment.

The non-institutional investors’ portion received bids for 1,07,00,972 shares against 17,63,572 on offer for this segment.

The Qualified Institutional Buyers (QIBs) portion have received 72,695 shares against 22,90,142 shares on offer for this segment.

Also Read: JG Chemicals IPO: Price band set at ₹210-221 per share; check issue details, key dates, more

JG Chemicals IPO details

JG Chemicals IPO, which is worth 251.19 crore, comprises a fresh issue of ₹165 crore, and an offer-for-sale (OFS) of up to 3,900,000 equity shares of face value of ₹10, aggregating to ₹86.19 crore, each by the promoters and other investors.

The selling shareholders are Vision Projects & Finvest Private Ltd (offloading up to 2,028,900), Jayanti Commercial Limited (selling up to 1,100 equity shares), Suresh Kumar Jhunjhunwala (HUF) (selling up to 1,260,000 equity shares), and Anirudh Jhunjhunwala (HUF) (offloading up to 610,000 equity shares).

The net proceeds will be used for the following purposes by the company: investing in the Material Subsidiary, BDJ Oxides; (i) repaying or prepaying all or some of the borrowings that the Material Subsidiary has taken out; (ii) financing the capital expenditures needed to establish a research and development centre in Naidupeta; and (iii) financing the extended working capital needs of the company.

The book running lead managers of the JG Chemicals IPO are Centrum Capital Limited, Emkay Global Financial Services Ltd, and Keynote Financial Services Ltd. The registrar of the offering is Kfin Technologies Limited.

JG Chemicals IPO GMP today

JG Chemicals IPO grey market premium is +50. This indicates JG Chemicals share price were trading at a premium of ₹50 in the grey market, according to investorgain.com.

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of JG Chemicals share price was indicated at ₹271 apiece, which is 22.62% higher than the IPO price of ₹221.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Also Read: J.G. Chemicals IPO: Zinc oxide maker raises ₹75.35 crore from anchor investors ahead of public issue

JG Chemicals IPO Review

JG Chemicals is India’s largest manufacturer of zinc oxide, according to the brokerage, in terms of production. Growing its business and operational breadth has allowed the company to become a major, diversified participant in the zinc oxide market.

The brokerage did point out that the business maintains lasting relationships with its suppliers and clients. The corporation enjoys a roughly 30% market share and a solid financial performance history. There are a few major risks, though, such as the industry’s competitiveness and reliance on the tyre and rubber sector.

“The IPO valuation of 12.75x P/E appears fairly priced on a current basis. While the company’s future growth potential and the positive industry outlook are encouraging thus we recommend Subscribe rating for this IPO,” the brokerage said.

Anand Rathi Share and Stock Brokers Ltd

In its report, the brokerage claimed that JG Chemicals holds a dominant market position, has a diverse customer base, and is a supplier to nine out of the ten largest tyre manufacturers worldwide as well as all eleven of the largest tyre manufacturers in India. It also boasts high barriers to entry in important end-use industries, a strong supply chain with over 250 customers over the last three years, and a focus on long-term sustainability through environmental initiatives.

“At the upper price band company is valuing at P/E of 15.76x and EV/EBITDA 12.3x with a market cap of ₹8,660 million post issue of equity shares. We believe that the IPO is fairly priced and recommend a “Subscribe-Long term” rating to the IPO,” said the brokerage.

Also Read: JG Chemicals IPO: 10 key risks investors should know before subscribing to the issue

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 06 Mar 2024, 01:12 PM IST