A Fund of Funds (FoFs) is a mutual fund that invests in other mutual funds or ETFs instead of directly in stocks, bonds, or other securities. They come in various types, such as equity-oriented, debt-oriented, hybrid, international, thematic or sectoral, ETF-based, and commodity fund of funds, each catering to different investor needs and offering diversification.

Commodity FoFs, for instance, focus on investing in commodities like gold or silver, providing exposure without the need to purchase them physically. International FoFs allow investors to gain global exposure.

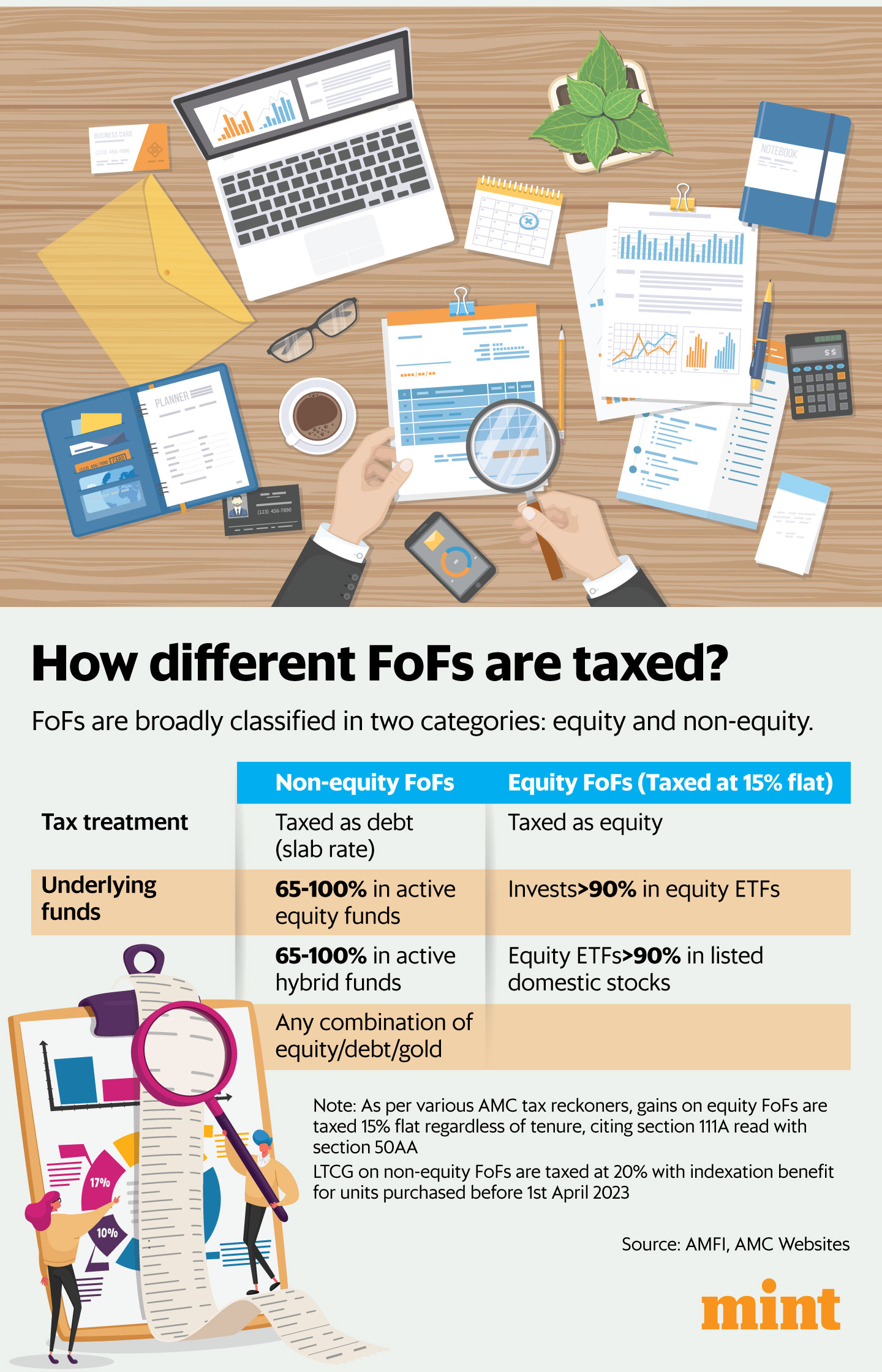

Understanding the taxation of FoFs is crucial as it impacts investment returns. Tax rules vary based on whether your FoF is equity-oriented or not, impacting both short-term and long-term capital gains. This knowledge helps investors take smarter decisions and optimize their tax liabilities.

View Full Image

How are FoFs taxed?

In India, mutual funds are categorized as equity-oriented or ‘other than equity-oriented’. For a fund to be equity-oriented, it must have at least 65% of its assets in stocks or equity-related instruments. ‘Other than equity-oriented funds’, they do not follow these criteria.

Fund of Funds (FoFs) have even stricter criteria. To be classified as equity-oriented, a FoF must invest at least 90% of its assets in Exchange Traded Funds (ETFs) that, in turn, invest at least 90% in shares of Indian companies listed on stock exchanges. If a FoF doesn’t meet these criteria, it is considered ‘other than equity-oriented’, even if it puts all its money into another equity fund.

This classification is important because it affects how the gains from these funds are taxed. Understanding these rules can help you choose a tax-efficient strategy. “As per the definition, for an FoF to be qualified as equity oriented fund, it should invest more than 90% in ETFs, Now these ETFs should be again investing minimum 90% in listed domestic shares,” says chartered accountant Nitesh Buddhadev, founder of Nimit Consultancy.

“For example, a FoF can have 100% allocation in any other equity or index fund. Still, it won’t have equity taxation because it does not invest a minimum of 90% in ETFs. Otherwise, the FoF will have debt taxation,” he added. As per tax reckoners released by various AMCs, gains on equity-oriented FoFs are taxed 15% flat regardless of tenure, citing section 111A read with section 50AA.

Section 50AA, introduced in Union Budget last year, stated that redemptions from funds with less than 35% invested in shares of domestic companies will be treated as short-term capital gains. The 15% tax rate is the short-term capital gains tax rate for equity funds.

Should you invest in FoFs?

Investing in FoFs offers several advantages. FoFs give you immediate diversification by spreading investments across various funds and asset classes in cost-efficient ways. This lets you build a broader asset allocation beyond equity and debt and thereby reduce risk. They are managed by seasoned professionals, saving investors the time and effort required for individual research and decision-making.

However, one major disadvantage of FoFs is their potential for a higher expense ratio compared to investing directly in individual mutual funds. This is because FoFs, in their expense ratios, also need to account for the costs linked with the underlying funds.

For example, ABC Equity Fund, might have a TER of 0.8%, whereas ABC FoF will have an additional 0.2% or higher expense to manage the cost of underlying funds.

As a result, investors in FoFs may end up paying higher fees for the convenience of investing in a diversified portfolio managed by a professional fund manager.

Despite these drawbacks, FoFs remain viable option for investors seeking diversified investment portfolios.