Apps cherry-pick funds that performed well in the past to paint a rosy picture. There are about 1,500 schemes available at an investor’s disposal at any point. The easiest way for these fintech apps to avoid confusing investors with too many options is to throw them a list of best-performing funds. However, experts caution against this strategy as the top-ranking schemes keep changing frequently.

“For every Infosys that has survived, there are many IT companies that shut down their shutters,” said Jethwani. “Similarly, in mutual funds, for every fund that has performed well, there are many that haven’t.”

Read more: Why regulatory restraints are not enough to contain retail trading in F&O

Another prevalent channel through which people buy mutual funds is banking. Many people—especially the older generation—happen to buy MFs through banks as they’re easy targets for the banks. Bank employees generally need to meet their sales targets and guiding investors is usually not their forte once the sales are done.

Direct fintech apps and banks might have intentions other than just selling MFs. This is because both have other avenues to mint more money. For some fintech apps, selling direct MFs may be a way to attract customers. The real business for many of these platforms is cross-selling other products like direct stocks or futures and options (F&O). Banks, on the other hand, may be incentivized more towards selling guaranteed insurance plans that fetch them multiples of the commission that they earn through MFs.

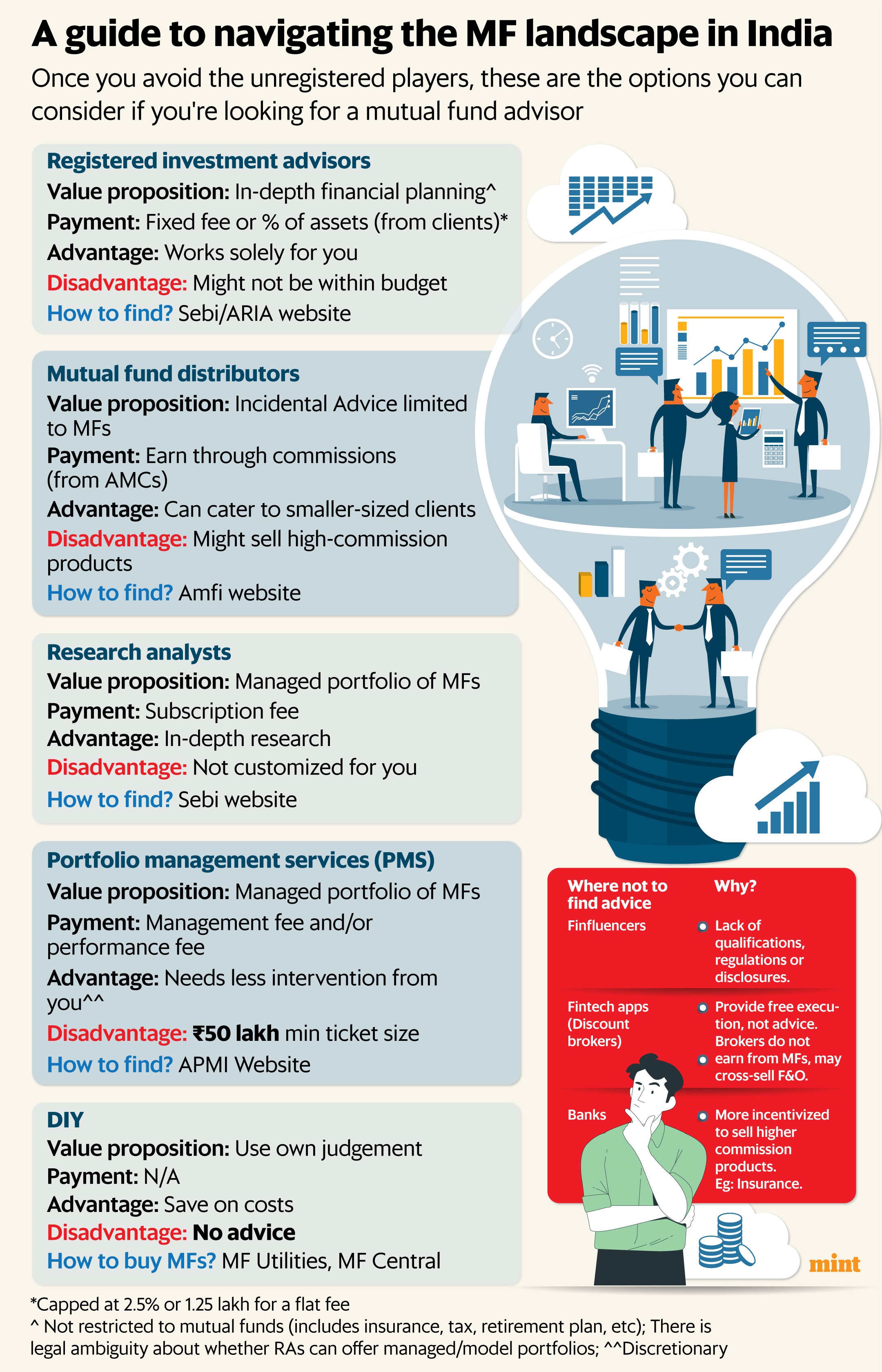

So, where can you get credible mutual fund advice? Here are the options along with their pros and cons.

View Full Image

MF distributors

There are 140,000 MF distributors spread across the country. If you start looking, you’ll likely find one in your locality. When you buy an MF through them, they get a small commission from the asset management company (AMC). Since they earn through commissions, some of them might end up giving you a product that fetches them the highest commission instead of one that is best suited for you.

Distributors can help investors get a basic idea of the MF scheme and handhold them through documentation, KYC-related issues, etc. In terms of recommending MFs, they can give incidental advice. Note the term ‘incidental advice’ that the Association of Mutual Funds in India (Amfi) tells distributors to provide. Advice by MF distributors should be incidental to the sales made but is not supposed to go beyond that.

The kind of advice that MF distributors are allowed to provide is still a gray area. However, since the barrier to becoming an MF distributor is pretty low, investors need to be careful while choosing the right one.

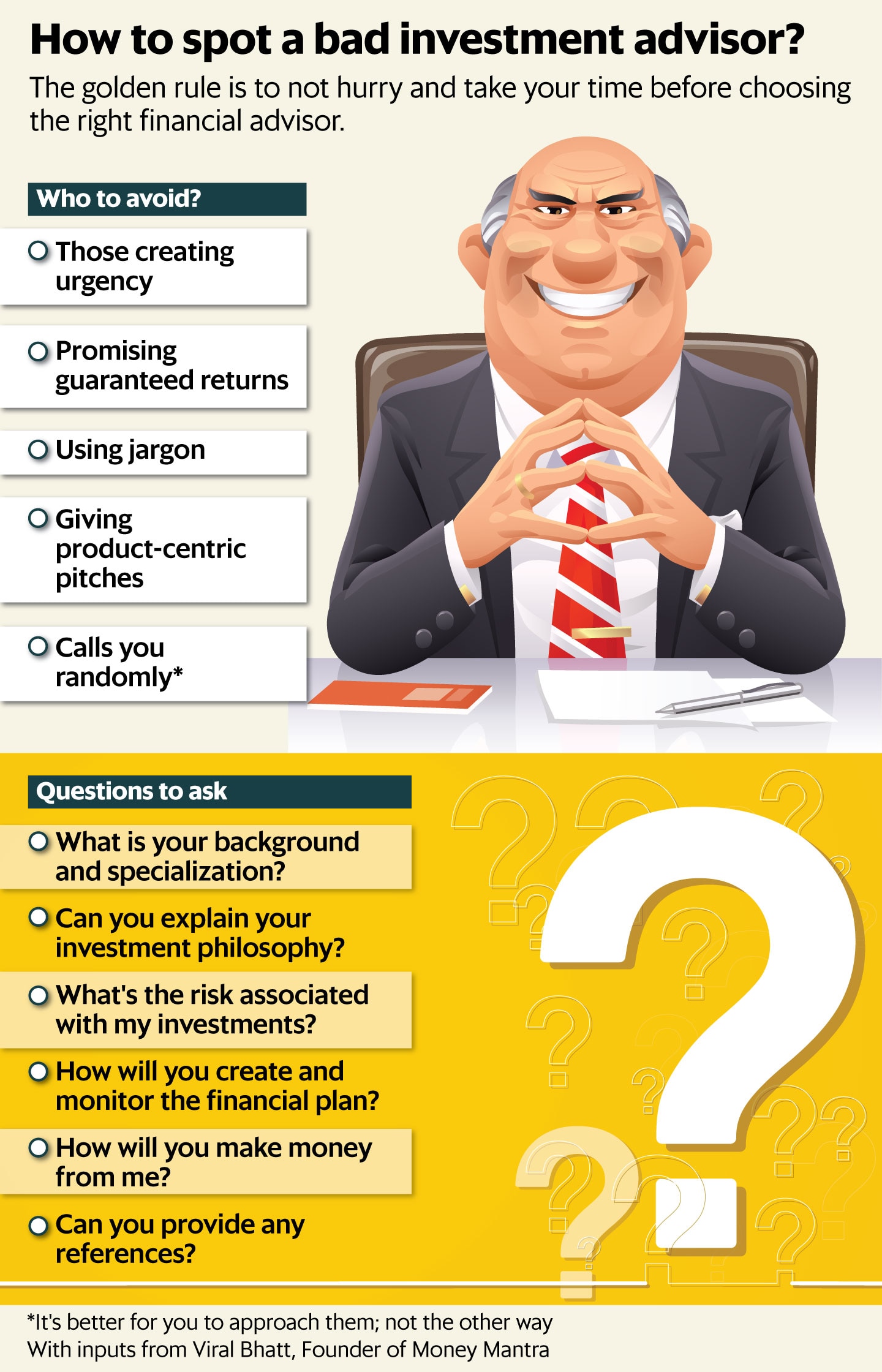

Viral Bhatt, who has been an MF distributor for more than a decade, says those creating a sense of urgency and putting pressure on investors to make quick decisions are a big red flag. Investors should also not fall for complicated products and should be wary of anyone offering guaranteed returns. Investors should not hurry and should first ask the MF distributor for their qualifications, understand their investment philosophy and, most importantly, ask how they earn from the transaction. Lastly, be upfront about the expectations you have from the MF distributor and talk about how they can help you with it.

View Full Image

Registered investment advisors

Unlike MF distributors who get their commissions from AMCs whenever an investor buys a mutual fund, some registered investment advisers (RIAs) charge a fixed fee from the client directly. This removes the incentive from the adviser to mis-sell products to earn higher commissions. Moreover, RIAs are allowed to make a holistic financial plan for an individual and a family. This means they are not just restricted to MFs but can tailor all your financial needs keeping in mind the risk appetite and your goals.

So, apart from MFs, if you also want to plan your taxes, want to know which insurance to buy, or if you should take a home loan, then an RIA can come in handy. They also periodically review your portfolio and hence keep you updated on what’s working and what needs tweaks. In some cases, RIAs even help in deciding whether you should leave your job and start a new venture of your own.

The major drawback of RIAs is that they are very few in number. There are less than 1,000 active RIAs across the country. Out of these, many are concentrated only in the metropolitan states. Large swathes of the country have no RIAs at all. This means that RIAs tend to work only with high-net-worth individuals. Vishal Dhawan, an RIA and founder of Plan Ahead Wealth Advisors, also pointed out that people don’t like paying fees from their pocket when everyone else is earning through costs embedded in the products themselves.

Portfolio management services

MFs go through cycles, but what if there was a fund manager actively taking a call on which MFs to own at a particular point? That’s exactly what some portfolio management service (PMS) providers seek to do. There is a fund that in turn invests in a bunch of carefully selected MFs.

But here’s the thing. The minimum ticket size is ₹50 lakh, which is not something that many investors have.

Since PMS is treated as a pass-through instrument, taxation happens on the holder’s account. This means that the taxation will be based on how often the PMS manager buys and sells MFs in your account.

Research analysts

Another option is to take a subscription with a research analyst for a fee. These are generally offered online, and when you buy a subscription, you get a list of recommended MFs. There is ambiguity on whether research analysts (RAs) can only give recommendations or create a model portfolio giving weightage to each scheme, for instance, whether they can simply recommend the top five funds or whether they can go ahead and allocate 30% to so-and-so scheme.

While RA services may work for those needing in-depth research on MFs, they might not be suitable for those who are not digitally savvy. That’s because this subscription will only give you research and recommendations, while the buying and selling of funds need to be carried out by the investors themselves. People with no background or knowledge about MFs might also face difficulty if they do not understand the basis of the given recommendation. Also, the model portfolio or research offered to all clients may not be customized to you.

What’s right for you?

In general, go for an RIA registered with the Securities and Exchange Board of India. There are highly competent individuals on other licences as well, such as PMS providers, MF distributors and RAs. Whichever entity you pick, ascertain their qualifications, experience and charges before you proceed.