TBO Tek’s initial public offering was subscribed 86.70 times on Friday, the last day of subscriptions, as per NSE data. The component for qualified institutional buyers (QIBs) was subscribed to 125.51 times, while the category for non-institutional investors garnered 50.60 times the subscriptions. The retail individual investors (RIIs) segment was subscribed 25.74 times.

Also Read: TBO Tek IPO allotment finalised; latest GMP, step-by-step guide to check status

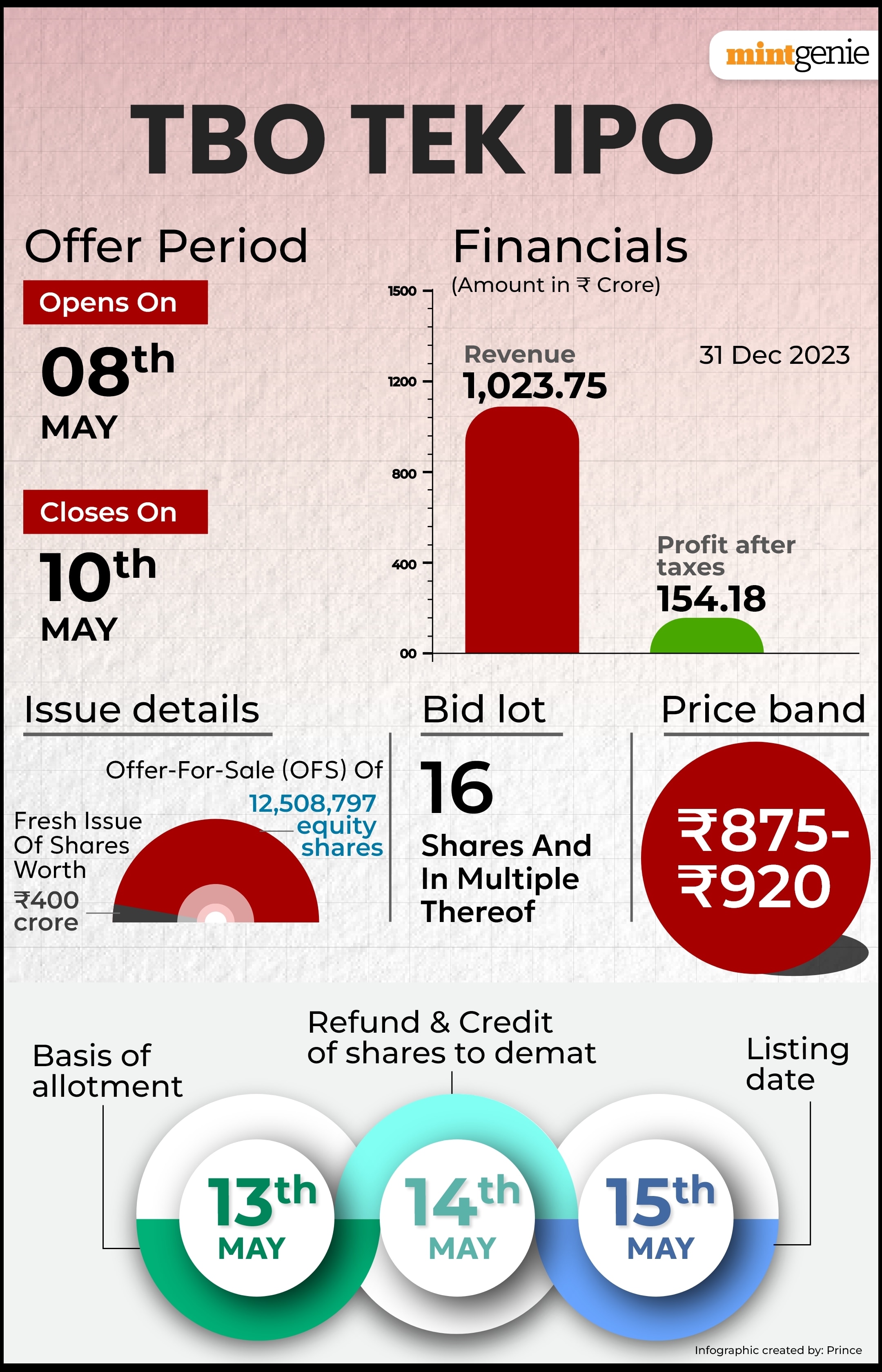

The issue’s price band has been set between ₹875 and ₹920 per equity share, with a face value of Re 1. Each lot in the IPO consists of 16 equity shares, and multiples of 16 equity shares will be issued thereafter. The IPO set aside 75% of the net offer for QIBs, 15% for NIIs, and 10% for retail investors. Employees have reserved equity shares worth up to ₹3 crore.

The firm simplifies the travel sector for providers such as hotels, airlines, car rentals, transfers, cruises, insurance, train companies, and others. Retail clients include travel agencies and independent travel advisors, as well as corporate customers such as tour operators, travel management businesses, internet travel companies, super apps, and loyalty apps. All of these parties benefit from the smooth connection enabled by the two-sided technological platform.

According to Prashanth Tapse, Research Analyst, Senior Vice President of Research at Mehta Equities, considering the strong subscription demand on the last day of the issue, especially QIB had soon huge interest subscribing demand to 125x, indicating a good room for healthy listing gains in the range of ~40–50% against the issue price of ₹450 per share.

“We believe the healthy listing is justified as the company holds a strong position in the global travel and tourism industry, which offers a comprehensive platform that creates significant value for both suppliers and buyers,” Tapse added.

Also Read: Upcoming IPOs: 6 new public issues and 12 new listings to keep primary market busy next week; check full list here

View Full Image

Let’s check what does TBO Tek IPO GMP today signal ahead of listing.

TBO Tek IPO grey market premium is +350. This indicates TBO Tek share price were trading at a premium of ₹350 in the grey market, according to investorgain.com.

Given the upper end of the IPO price band and the current grey market premium, the estimated listing price for TBO Tek IPO is ₹1,270 per share, which is 38.04% more than the IPO price of ₹920.

Based on the previous 15 sessions of grey market activity, today’s IPO GMP is going upward and predicts a solid listing. According to investorgain.com experts, the lowest GMP is ₹0, and the maximum is ₹540.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Also Read: TBO Tek IPO day 3: GMP, subscription status to review. Should you apply?

TBO Tek IPO details

TBO Tek IPO, which is worth ₹1,550.81 crore, comprises a fresh issue of ₹400 crore, and an offer-for-sale (OFS) of up to 12,508,797 equity shares of face value of Re 1 each by the promoters and other investors.

Promoters of the firm Manish Dhingra, LAP Travel, and Gaurav Bhatnagar announced that 52.12 lakh shares will be sold through OFS. 72.96 lakh shares of the firm will be sold by its other investors, TBO Korea and Augusta TBO, who own respective stakes of 11.06 percent and 19.53 percent.

The Red Herring Prospectus for TBO Tek’s initial public offering (IPO) states that public shareholders possess 46.43 percent of the firm, while corporate promoters own 51.26 percent of this online travel distributor.

With a 19.53 percent ownership holding, Augusta TBO is the company’s largest public stakeholder. 15,635,994 company shares, or 15% of the firm’s total paid-up capital, are owned by General Atlantic.

TBO Korea has 11,523,854 shares in the firm, or 11.06 percent of its total ownership. 98.54 percent of the firm is owned by promoters and public shareholders, while the remaining 2.31 percent is owned by the TBO ESOP Trust, a non-promoter and non-public shareholder institution.

The firm plans to use the net funds from the offering to finance the following goals: growing the network of suppliers and buyers; enhancing the platform’s value by introducing new business categories; utilising data acquired to provide customised travel solutions to our suppliers and buyers; and inorganic development through strategic acquisitions and creating synergies with our current platform.

The book running lead managers of the TBO Tek IPO are Axis Capital Limited, Jefferies India Private Limited, Goldman Sachs (India) Securities Private Limited, and Jm Financial Limited. The issue’s registrar is Kfin Technologies Limited.

Also Read: TBO Tek IPO to open tomorrow: GMP, issue details, 10 key things to know before investing to ₹1,551-crore issue

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 14 May 2024, 12:46 PM IST